Loading

Get Mn 2008 M8 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mn 2008 M8 Form online

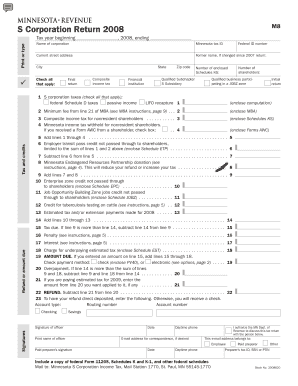

Filling out the Mn 2008 M8 Form online can seem daunting, but with a step-by-step approach, you can complete the process efficiently. This guide aims to provide clear instructions to help you navigate the form easily.

Follow the steps to complete the Mn 2008 M8 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the tax year beginning in the appropriate field, ensuring you indicate '2008'.

- Fill out the name of the corporation, Minnesota tax ID, and the current street address.

- If applicable, provide the former name of the corporation if it has changed since your 2007 return.

- Complete the city, state, and zip code fields accurately.

- Check all applicable boxes such as 'Final return', 'Initial return', or 'Composite income tax'.

- Complete lines 1 through 4 based on specific taxes and credits related to your S corporation.

- Enter the total number of shareholders and the number of enclosed Schedules KS.

- Calculate and enter the minimum fee from line 21 of M8A within line 2.

- Continue filling out the tax credits, taxes due, and any penalties on the relevant lines.

- Subtract any applicable lines to calculate amounts due or refunds.

- Provide your bank information if you wish to direct deposit any refund.

- Make sure to include all necessary signatures and e-mail information for correspondence.

- Finally, review all entries for accuracy before submitting the form.

Complete your Mn 2008 M8 Form online to ensure a timely and accurate filing!

In Minnesota, you can claim several deductions on your state taxes, including property tax, mortgage interest, and medical expenses. Additionally, if you qualify for certain credits or deductions, such as the K-12 Education Credit or Child and Dependent Care Credit, they can significantly lower your taxable income. Be sure to review the requirements carefully to maximize your deductions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.