Loading

Get State Of Mn Charitable Organization Initial Registration 2010 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the State of Mn Charitable Organization Initial Registration 2010 Form online

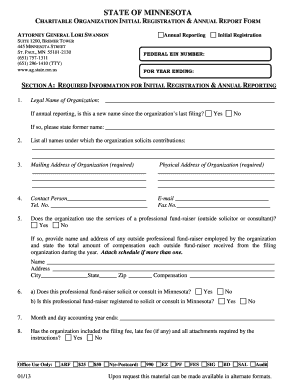

Filling out the State of Minnesota Charitable Organization Initial Registration 2010 Form online is a critical step for organizations seeking to operate legally within the state. This guide provides a comprehensive overview of each section and field of the form, ensuring a smooth and accurate completion process.

Follow the steps to complete your registration online.

- Use the ‘Get Form’ button to obtain the form and open it in your editor of choice.

- Begin with Section A, where you must provide the legal name of the organization. Note if the name has changed since the last filing and mention the former name if applicable.

- List all names under which the organization solicits contributions in the designated area, followed by entering the mailing and physical address of the organization.

- Provide the contact person’s name, telephone number, email, and fax number in the appropriate fields.

- Indicate whether the organization employs a professional fund-raiser. If yes, include the fund-raiser’s name, address, and total compensation received during the year.

- Specify the month and day when the accounting year ends and ensure all required attachments and fees are included.

- Complete Section B, detailing the address of the registered agent or custodian of the organization's records, and specify the type of legal entity.

- State whether the organization is exempt from federal income taxes and, if so, attach the IRS determination letter.

- By answering 'Yes' or 'No', provide explanations regarding any changes in tax status or soliciting rights. Detail the charitable purposes and list all relevant charitable missions.

- Check all anticipated methods of solicitation and enter the total contributions received during the last accounting year.

- In Section C, answer all annual reporting questions truthfully and attach required lists and explanations.

- Complete Section D with the names, titles, and signatures of duly constituted officers, certifying the accuracy of the provided information.

- Once the form is completed, save changes, and use the online features to download, print, or share the form as needed.

Start completing your registration form online today to ensure your organization can continue its charitable work legally.

To start a nonprofit in Washington D.C. and get 501(c)(3) status, follow these steps: Step 1: Name Your Washington D.C. Nonprofit. Step 2: Choose Your Registered Agent. Step 3: Select Your Board Members & Officers. Step 4: Adopt Bylaws & Conflict of Interest Policy. Step 5: File the Articles of Incorporation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.