Get Rhode Island Partnership Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rhode Island Partnership Return online

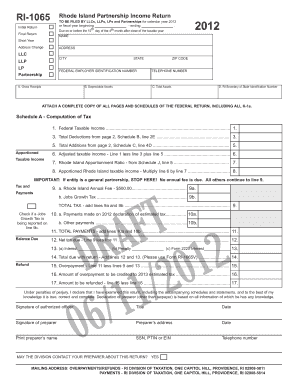

The Rhode Island Partnership Return (RI-1065) is essential for partnerships, LLCs, LLPs, and LPs to report their income and pay taxes in accordance with state regulations. This guide offers a detailed walkthrough on how to successfully complete the form online, ensuring that you meet all requirements and deadlines.

Follow the steps to accurately complete your Rhode Island Partnership Return.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online platform.

- Enter the name of the partnership in the designated field. Make sure to provide the legal name as registered with the state.

- Fill out the address section, including street address, city, state, and zip code. Ensure that the address corresponds with the registration details.

- Provide the federal employer identification number (EIN) in the appropriate field. This number is critical for identification purposes.

- Complete the contact information, including the telephone number of the partnership.

- In Section A, report the gross receipts, depreciable assets, and total assets as required.

- Proceed to attach a complete copy of all pages and schedules of the federal return, including all K-1s. This is essential for processing your return.

- Move to Schedule A - Computation of Tax. Input the federal taxable income, total deductions from Schedule B, and total additions from Schedule C.

- Calculate the adjusted taxable income by subtracting total deductions from federal taxable income and adding any total additions.

- Fill out the Rhode Island Apportionment Ratio as indicated in Schedule J, then calculate the apportioned Rhode Island taxable income.

- If your entity is not a general partnership, report the Rhode Island annual fee and any applicable taxes on line 9.

- Sum up all payments made on the 2012 declaration of estimated tax and any other payments to determine the total payments.

- Determine if there is a balance due by calculating net tax due and any applicable interest or penalties.

- Review sections related to overpaying or refund requests. Specify any amounts to be credited to future estimated taxes or refunded.

- Finally, review the declaration of the preparer, ensuring all necessary signatures and dates are executed correctly.

- Save changes, download a copy for your records, and print or share the form as needed.

Complete your Rhode Island Partnership Return online today to ensure compliance and timely filing.

Yes, you can file the RI-1065 yourself if you have the necessary financial information and understand the filing process. However, accurately completing the Rhode Island Partnership Return can be complex, especially if your partnership has multiple partners or unique deductions. If you want to ensure accuracy and compliance, you might consider using US Legal Forms, which offers user-friendly resources and templates tailored specifically for this purpose.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.