Loading

Get 2010 7004 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2010 7004 Form online

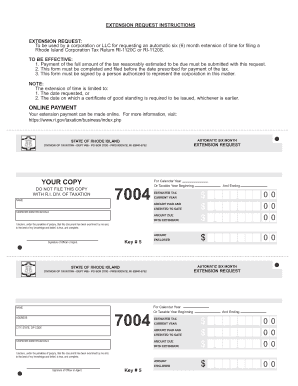

Filling out the 2010 7004 Form online can streamline the process of requesting an automatic extension for your Rhode Island Corporation Tax Return. This guide offers clear, step-by-step instructions to assist you in accurately completing the form.

Follow the steps to complete the 2010 7004 Form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by entering the name of the corporation or LLC in the designated field. Ensure that this is the legal name as recognized by the state.

- Indicate the calendar year or taxable year for which you are requesting the extension. This should match the tax year that your return pertains to.

- Fill in your taxpayer identification number in the appropriate section. This is essential for the processing of your request.

- Input the estimated tax amount for the current year. This is the total amount of tax you anticipate owing for this tax year.

- Provide the amount that has already been paid and credited to date. This helps determine how much you owe with the extension.

- Calculate and enter the amount due with the extension. This is crucial as the extension is only valid if the estimated payment is submitted.

- Lastly, the form must be signed by an authorized person representing the corporation. Ensure that the signature is included before submission.

- Once all fields are accurately filled out and reviewed, you can save the changes, download the completed form, print it for your records, or share it with relevant parties.

Take the first step towards completing your documents online today!

If you're filing LLC taxes late, you can use the 2010 7004 Form to request an extension. Complete the form with your LLC's information and submit it promptly. Additionally, consider consulting UsLegalForms for resources that guide you through late filing to minimize penalties and ensure compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.