Loading

Get Ri Form 100

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ri Form 100 online

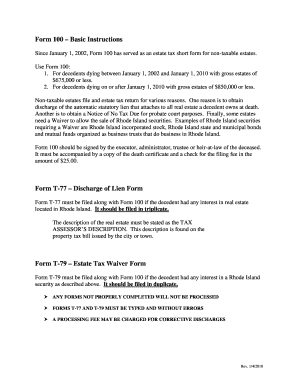

Filling out the Ri Form 100 is an essential step for users managing non-taxable estates. This guide provides clear and supportive instructions to assist you in completing the form online with ease.

Follow the steps to successfully complete the Ri Form 100 online.

- Press the ‘Get Form’ button to access the document and open it in your preferred online editor.

- Review the introductory section of Form 100 to understand its purpose and requirements. Ensure that your estate qualifies based on the date of death and gross estate value criteria.

- Fill in the decedent's information, including full name, date of death, and gross estate value. Ensure accuracy to prevent processing delays.

- Complete any additional necessary sections related to the discharge of liens or waivers if applicable. Refer to Form T-77 if there is real estate involved, or Form T-79 for Rhode Island securities.

- Attach a copy of the death certificate as required. Ensure the document is clear and legible to comply with submission standards.

- Include the filing fee of $25.00. Confirm that the payment method is correctly selected if completing the process online.

- Review the entire form for accuracy and completeness. Double-check all entries to avoid common errors that can lead to rejections.

- Once you have filled out the form and confirmed all details are correct, proceed to save your changes, and choose to download, print, or share the completed form as needed.

Begin your online document management process by completing the Ri Form 100 today.

A 1040 tax form is a standard IRS document for individual income tax returns in the United States. It captures detailed information about your income, deductions, and credits, allowing you to calculate your overall tax liability. If you seek more information on completing your 1040, the US Legal Forms platform offers various resources to help you.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.