Loading

Get T79 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the T79 Form online

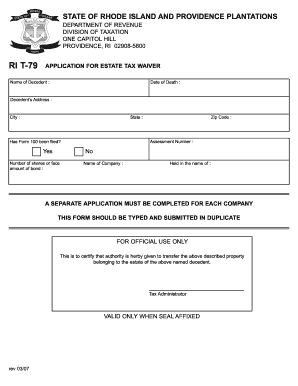

Completing the T79 Form for an estate tax waiver is an essential step in managing estate matters. This guide will provide you with clear, step-by-step instructions to help you fill out the form accurately and efficiently online.

Follow the steps to complete the T79 Form online.

- Click the ‘Get Form’ button to obtain the T79 Form and open it in the editor.

- Begin by entering the name of the decedent in the designated field. Ensure that you provide the full legal name as it appears on official documents.

- Next, input the date of death. This should be formatted as MM/DD/YYYY to ensure clarity.

- Fill in the decedent's address, including city, state, and zip code. This information is crucial for identifying the estate.

- Enter the assessment number, if applicable. This will often correlate with tax assessments for the estate.

- Indicate whether Form 100 has been filed by selecting 'Yes' or 'No' in the corresponding field. Make sure to check the appropriate box.

- Specify the number of shares or face amount of bonds involved in the estate. Be accurate to reflect the assets clearly.

- Provide the name of the company associated with the shares or bonds in the form.

- Complete the field for 'Held in the name of' by entering the name of the individual or entity that currently holds the assets.

- Remember that a separate application is required for each company listed. Ensure you have the correct documentation for each.

- Once all fields are filled out accurately, review the entire form for any errors or omissions.

- Finally, save your changes. You have the option to download, print, or share the completed T79 Form as needed.

Start completing your documents online today.

In TurboTax, you can find Form 8879 within the e-filing section after you've finished your tax return. Navigate to the forms section, and it will usually be listed among the documents you can review. Additionally, when preparing to e-file, TurboTax will guide you to generate the 8879 without hassle. Make sure to review it alongside the T79 Form to ensure all your information aligns.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.