Loading

Get Ri Form 100 A Electronic

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ri Form 100 A Electronic online

Filling out the Ri Form 100 A Electronic online can seem daunting, but with clear guidance, you can navigate the process smoothly. This comprehensive guide will provide step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the Ri Form 100 A Electronic online

- Click 'Get Form' button to obtain the Ri Form 100 A Electronic and open it in your online editor.

- Begin by providing the decedent's information in the first section. This includes their full name, date of death, and Social Security number.

- In the next section, enter the details regarding the estate. This may involve listing assets, liabilities, and any relevant estate tax information.

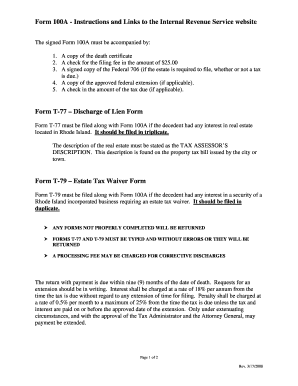

- Include any necessary accompanying documents as specified in the instructions. Make sure to have a copy of the death certificate, a check for the filing fee, and any federal forms required.

- If applicable, ensure you attach Form T-77 for real estate interests or Form T-79 for interests in a Rhode Island incorporated business.

- Review the completed form carefully for any missing information or errors. It is crucial that all sections are accurately filled to avoid delays.

- Once you are satisfied with the completion of the form, save your changes. You may then download, print, or share the form as needed.

Start completing your Ri Form 100 A Electronic online today!

Rhode Island does not impose an inheritance tax as part of its tax structure. However, there may be other taxes applicable upon death, such as the estate tax. It is particularly relevant to high-value estates, so understanding local laws is crucial. To navigate estate-related questions, using the RI Form 100 A Electronic can provide you with the necessary frameworks for compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.