Loading

Get Ri Form 100

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ri Form 100 online

Filling out the Ri Form 100 online is a vital step in managing estate tax matters in Rhode Island. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the Ri Form 100 online.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

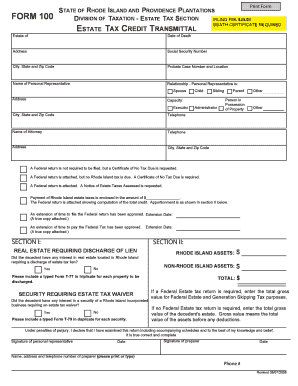

- Start by entering the estate information. Fill in the decedent's name, date of death, address, social security number, and probate case number and location accurately.

- Next, provide the name and address of the personal representative. Indicate their relationship to the decedent and their capacity (executor or administrator) within the designated fields.

- Input the name, telephone number, and address of the attorney representing the estate, if applicable.

- Determine if a Federal return is required and choose the appropriate option in the section provided. You will need to indicate payment amounts or attach necessary documentation based on your selected option.

- In Section I, answer the questions concerning real estate by selecting 'Yes' or 'No' for the discharge of lien requirement.

- Continue to Section II by answering whether the decedent had any interest in a security requiring an estate tax waiver and include the required typed Form T-79.

- Calculate the total values in the respective areas, ensuring accuracy in the reported amounts for Rhode Island and non-Rhode Island assets.

- At the end of the form, signatures are required from both the personal representative and preparer. Ensure the dates of signing are also included.

- Once all fields are filled and double-checked for accuracy, save your changes. You can download, print, or share the completed form as needed.

Complete the Ri Form 100 online today to manage your estate tax responsibilities efficiently.

Form RI 1040 is the state income tax return form used in Rhode Island for individuals. This form captures essential information about your income, deductions, and any credits to calculate the state tax owed. Understanding how to fill out the RI 1040 properly is crucial for compliance, and using supportive platforms like USLegalForms can simplify the process significantly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.