Loading

Get Ri 1310

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ri 1310 online

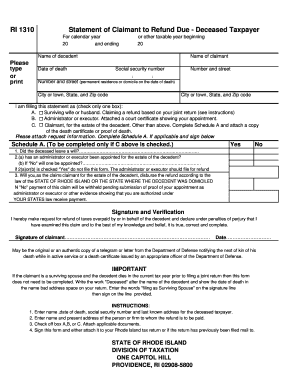

Filling out the Ri 1310 form, a statement of claimant to refund due for a deceased taxpayer, is a straightforward process. This guide will provide you with step-by-step instructions to ensure that you complete the form accurately and efficiently.

Follow the steps to fill out the Ri 1310 form online

- Click the ‘Get Form’ button to obtain the Ri 1310 form, which will open for you to fill out.

- Begin by entering the name of the decedent, the date of death, and their social security number. Ensure that this information is accurate to avoid any issues with processing.

- Fill in the last known address for the decedent, including the number and street, city or town, state, and zip code.

- Next, enter your information as the claimant, including your name and current address as required.

- Indicate your relationship to the decedent by checking only one box: A for surviving spouse, B for administrator or executor with attached court certification, or C for a claimant for the estate. If you select C, ensure to complete Schedule A and attach necessary documentation such as the death certificate.

- If you have checked option C, complete Schedule A by answering the questions regarding the will and appointment of an executor or administrator.

- Sign and date the form to validate your request for the tax refund, affirming that the information provided is true and complete.

- Once you have filled out the form, you can save your changes. Depending on your preference, proceed to download, print, or share the completed form.

Complete your Ri 1310 form online today to ensure timely processing of your tax refund.

Filing the last tax return for a deceased person involves gathering necessary documents and completing both the tax return and Form 1310. Ensure you have the correct information about the taxpayer's income and deductions. Using the US Legal Forms platform can assist you in preparing all required forms and understanding the filing process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.