Get Irs Form Wfc Dp

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irs Form Wfc Dp online

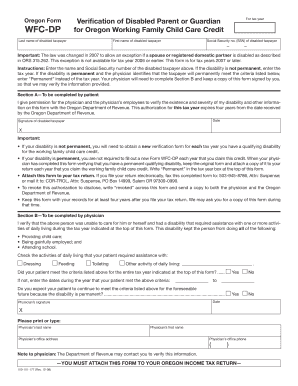

The IRS Form WFC-DP is essential for individuals seeking the Oregon Working Family Child Care Credit, particularly when verifying the disability of a parent or guardian. This guide provides clear, step-by-step instructions to ensure that users can efficiently complete the form online.

Follow the steps to successfully complete the Irs Form Wfc Dp online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- In the first section, enter the last name and first name of the disabled taxpayer. Make sure to provide accurate information as this is crucial for verification purposes.

- Next, specify the tax year for which the credit is being applied. If the disability is permanent, simply write 'Permanent' instead of the tax year.

- Enter the Social Security number (SSN) of the disabled taxpayer. Ensure that this information is kept confidential and secure.

- Proceed to Section A, where the disabled taxpayer must provide their signature and the date. This section authorizes the physician to verify disability information with the Oregon Department of Revenue.

- Make sure to discuss the verification of disability with the physician, as they will need to fill out Section B. This includes their signature, verification of the condition, and details about the activities of daily living the taxpayer required assistance with.

- Once the form is completely filled out, save your changes and download a copy for your records. You can print it out if necessary.

- Finally, attach the completed form to your tax return. If you are filing electronically, fax the completed form to the provided number or mail it to the specified address.

Start filling out the Irs Form Wfc Dp online today to ensure you receive your eligible tax credits.

You can easily access IRS forms online through the official IRS website. Simply visit the IRS forms page, where you can search for specific forms like the IRS Form Wfc Dp. Additionally, platforms like US Legal Forms offer a user-friendly way to find and download IRS forms securely. By using these resources, you ensure that you're getting the most accurate and up-to-date information.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.