Loading

Get Wr 2014 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wr 2014 Form online

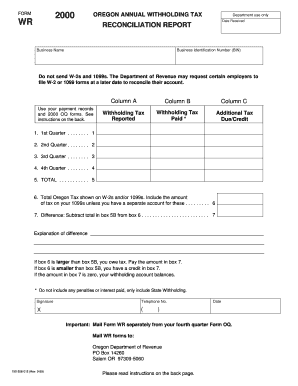

Filling out the Wr 2014 Form online can simplify the reconciliation of your annual withholding tax for Oregon. This guide provides clear, step-by-step instructions to help you navigate through each section of the form seamlessly.

Follow the steps to complete the Wr 2014 Form online effectively.

- Click the ‘Get Form’ button to access the Wr 2014 Form and open it in your preferred online editor.

- Enter your business name and Oregon business identification number (BIN) in the designated fields.

- In Column A, list the total Oregon tax reported for each quarter based on your records and the totals from your 2000 OQ forms.

- In Column B, fill in the total amount of Oregon tax you have paid for each respective quarter. Avoid including any penalties or interest.

- Calculate the difference between the amounts in Column A and Column B for each quarter and enter these values in Column C. Use brackets to denote any credits.

- In Box 6, enter the total Oregon tax reported on your employees' W-2s and/or 1099s. Ensure the amounts are accurate and account for all necessary reporting.

- For Box 7, calculate the difference between the total tax paid in Box 5B and the total tax reported in Box 6. This will indicate whether you owe tax or have an overpayment.

- Sign and date the form, and include your phone number in the appropriate field.

- Once completed, save the changes, then download, print, or share the form as needed. Remember to mail it separately from your fourth quarter Form OQ to the Oregon Department of Revenue.

Start completing your Wr 2014 Form online today for a simplified filing experience!

Getting W-2 forms from previous years typically involves contacting your past employer to request duplicates. If your employer cannot provide them, you can file Form 4506-T with the IRS for a transcript of your earnings. This can repeat the W-2 information for tax years needed. For more structured guidance, UsLegalForms offers resources to help you navigate this process effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.