Loading

Get Oklahoma Minimummaximum Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Oklahoma Minimum/Maximum Form online

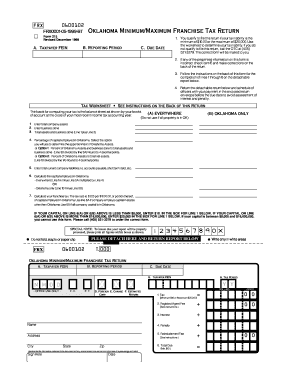

Filing the Oklahoma Minimum/Maximum Franchise Tax Return can seem daunting, but this guide will provide clear, step-by-step instructions to help you navigate the process online. Completing this form accurately ensures compliance with state tax regulations.

Follow the steps to complete your Oklahoma Minimum/Maximum Form online

- Click ‘Get Form’ button to obtain the form and open it in the document editor.

- Enter your taxpayer FEIN in the designated field. Ensure that this information is correct to avoid any processing delays.

- Indicate the reporting period for which you are filing the tax return. This should align with your accounting year.

- Review the preprinted information. If any is incorrect, check Item E and make necessary corrections in the appropriate space on the back of the return.

- Complete the tax calculation by determining your capital employed in Oklahoma using the provided worksheet. Select the option (1 or 2) for apportionment based on your business operations.

- Fill out the tax due, which should either reflect the minimum of $10 or the maximum of $20,000 based on the calculated capital.

- Complete the officer information section accurately. If there are any changes to preprinted information, ensure these are noted.

- After final checks, you can save changes, download the form, or print it directly for submission. Email or share as necessary.

Ensure compliance—complete your Oklahoma Minimum/Maximum Form online today!

Yes, you can file Oklahoma Form 200 electronically. E-filing offers a convenient and efficient way to submit your state tax return. Utilizing online platforms that accommodate forms like the Oklahoma Minimummaximum Form can enhance your filing experience, ensuring you meet deadlines without unnecessary hassle.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.