Get Okla 538 H 2016 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Okla 538 H 2016 Form online

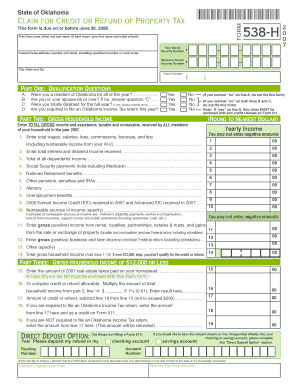

The Okla 538 H 2016 Form is essential for individuals seeking a credit or refund of property tax in Oklahoma. This guide provides clear, step-by-step instructions to help you complete this form online effectively.

Follow the steps to fill out the form correctly.

- Press the 'Get Form' button to access the Okla 538 H 2016 Form and open it in your online editor.

- Begin by entering your first name, middle initial, and last name. If you are filing jointly, include the information for your partner as well.

- Provide your Social Security number and, if applicable, your partner's Social Security number in the designated fields.

- Fill out the present home address section, including the street number, street name, apartment number (if applicable), city, state, and zip code.

- Move to Part One, answer the qualification questions regarding your residency status in Oklahoma, age, disability status, and tax filing requirements. Use the provided checkboxes to indicate your responses.

- Proceed to Part Two to report your gross household income. Carefully enter the amounts in each corresponding field, including wages, interest income, social security payments, and other specified income sources.

- Calculate the total gross household income by summing all reported amounts in Part Two, and check if this total exceeds $12,000. If it does, you will not qualify for the credit or refund.

- In Part Three, if your total household income is $12,000 or less, enter the amount of real estate taxes you paid on your homestead. Make sure to attach a copy of your tax bill.

- Calculate the allowable credit or refund by multiplying your total household income by 1% and entering it in the designated field.

- Subtract the calculated amount from your real estate taxes paid to find your credit or refund amount, ensuring it does not exceed $200.

- If required to file a tax return, enter the refund amount as a credit on Form 511. If not required, indicate this amount as a refund.

- If you wish to receive your refund via direct deposit, fill in the routing and account numbers in the Direct Deposit Option section.

- Finally, sign and date the form along with your partner if applicable, affirming the accuracy of the information provided.

- After completing the form, you can save your changes, download it for your records, or print it to submit via mail to the Oklahoma Tax Commission.

Complete your Okla 538 H 2016 Form online to ensure your property tax credit or refund is processed efficiently.

In Oklahoma, the farm tax exemption is available to individuals and businesses engaged in agricultural activities. Qualifying activities usually involve the production of crops, livestock, or farm-related products. To apply for this exemption, you'll need to provide relevant documentation, including the Okla 538 H 2016 Form. Understanding these qualifications can help farmers take advantage of tax relief opportunities and support their agricultural endeavors.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.