Loading

Get Otc 924

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Otc 924 online

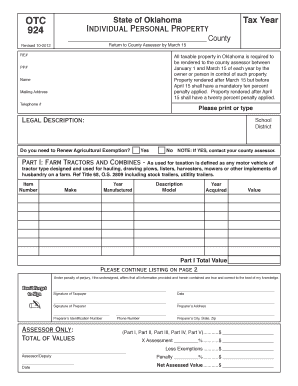

The Otc 924 form is essential for reporting individual personal property in Oklahoma. This guide will walk you through the process of filling out the form online, ensuring you accurately provide all required information.

Follow the steps to successfully complete your Otc 924 form online.

- Press the ‘Get Form’ button to access the Otc 924 form and open it in your preferred editing tool.

- Fill in the tax year and county where the property is located at the top of the form.

- Provide your residential or business information, including the RE# (Reference Number), PP# (Personal Property Number), your name, mailing address, and telephone number.

- Enter the legal description of the property, and indicate the school district.

- Answer whether you need to renew the agricultural exemption by selecting 'Yes' or 'No', and if 'Yes', note that you should contact your county assessor.

- In Part I, detail information about farm tractors and combines by entering each item number, year manufactured, make, description, model, year acquired, and estimated value.

- Proceed to Part II to list farm equipment, providing the same details for each item as in Part I.

- For Part III, list unmanufactured farm products, including their type and estimated value as of May 31 of the previous year.

- In Part IV, enter details about your livestock including the type and number of each, alongside their assessed value.

- In Part V, describe any improvements on leased land, their type, and estimated value.

- Now, sum the total values from Parts I through V to calculate the overall total value.

- Finally, ensure to sign the form where indicated and provide the signature of any preparer along with their identification number.

- Once completed, save any changes, and choose to download, print, or share the form as required.

Complete your Otc 924 form online today to ensure timely submission and avoid penalties.

To qualify for an agricultural tax exemption, the property must be actively used for agricultural purposes such as farming, ranching, or related activities. The exemption is designed to support individuals or businesses that contribute to agricultural production. It's important to maintain records of your agricultural activities for verification. The process can be navigated effectively with resources related to OTC 924.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.