Loading

Get Employer Response Wage Claim Oklahoma Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Employer Response Wage Claim Oklahoma Form online

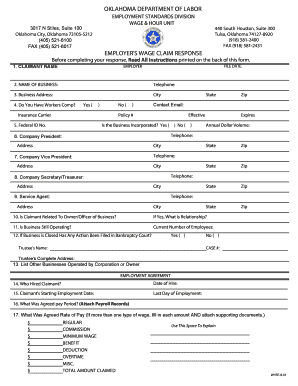

Completing the Employer Response Wage Claim Oklahoma Form online is an important step for employers in addressing wage claims filed by employees. This guide provides clear instructions to help you navigate the form accurately and efficiently.

Follow the steps to complete your Employer Response Wage Claim Oklahoma Form online.

- Press the ‘Get Form’ button to access the Employer Response Wage Claim Oklahoma Form and open it in a suitable editor.

- Begin by filling in the claimant's name and the file date. Ensure that you are entering accurate information, as this will be essential for processing the claim.

- Next, provide your business name, telephone number, and complete business address, including city, state, and zip code. This identifies your organization as the employer.

- Indicate whether you have workers' compensation insurance by selecting 'Yes' or 'No.' If applicable, enter the name of your insurance carrier, policy number, and the address for correspondence.

- Enter your Federal ID number and the annual dollar volume of your business. Additionally, confirm if your business is incorporated by selecting the appropriate option.

- Provide the contact information of the company president, including their name, address, and phone number.

- Likewise, enter the name and contact details for the company vice president and secretary/treasurer.

- Designate a service agent and include their contact information as well.

- Answer the question regarding the relationship of the claimant to an owner or officer of the business. This provides context for the claim.

- State whether the business is currently operating and include the number of employees if applicable.

- If the business is closed, indicate if any action has been filed in bankruptcy court, including the trustee's details if applicable.

- List any other businesses operated by your corporation or an owner, which provides a broader context of your operations.

- Address the employment agreement by noting who hired the claimant and their dates of employment.

- Specify the agreed rate of pay and attach any relevant payroll records to support your claims.

- Indicate if the claimant has any of your property and whether there are any documents authorizing deductions beyond regular payroll.

- If applicable, confirm if the claimant worked the hours they claimed, and attach relevant timekeeping documentation.

- Respond to questions regarding holiday, vacation, or similar payments, and attach copies of any written policies related to these.

- Indicate whether any wages have been paid to the claimant and provide verification of those payments.

- Finally, state the gross amount you acknowledge is owed to the claimant and specify reasons for any discrepancies with the claimant's claims.

- Once you have completed all sections of the form, review your entries for accuracy, and ensure all necessary documentation is attached. Save your changes, and download or print the completed form for your records.

Complete your Employer Response Wage Claim Oklahoma Form online today to ensure compliance and timely response.

No, it is illegal for employers to retaliate against you for filing a wage claim. Filing the Employer Response Wage Claim Oklahoma Form is your right, and employers cannot dismiss or penalize you for exercising that right. If you experience retaliation, it is advisable to report it to the Department of Labor immediately to protect your rights.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.