Loading

Get Form Rp-6603-v:2/06:report Of Total Assessed Value Of Locally ... - Tax Ny

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form RP-6603-V:2/06:Report Of Total Assessed Value Of Locally Assessed Properties online

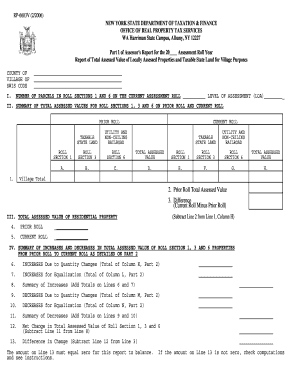

This guide provides a step-by-step approach to filling out the Form RP-6603-V:2/06, which reports the total assessed value of locally assessed properties. Users can complete the form online, ensuring accurate submission to the New York State Department of Taxation & Finance.

Follow the steps to accurately complete the form online:

- Click the ‘Get Form’ button to access the form and open it for editing.

- Begin with Part I, where you will enter the county and village information, as well as the number of parcels in roll sections 1 and 6 on the current assessment roll.

- Provide the level of assessment (LOA) in the designated field.

- Proceed to Part II and summarize the total assessed values for the current roll and prior roll, filling in the appropriate values for roll sections 1, 3, and 6.

- In Part III, indicate the total assessed value specifically for residential properties on both the prior roll and the current roll.

- Complete Part IV by detailing any increases and decreases in the total assessed value from the prior roll to the current roll, using the provided subfields.

- In Part V, summarize total assessed values for locally assessed properties in roll sections 1 and 6, especially if applicable to homestead assessing units.

- Part VI requires you to answer questions regarding any agricultural exemptions and conversions of land use.

- Enter the names and contact information of individuals who can address questions about this report in the specified section.

- Finalize by certifying the accuracy of the information provided with an authorized signature and date.

- Once all fields have been filled out correctly, save the changes, and proceed to download, print, or share the completed form as required.

Complete your Form RP-6603-V:2/06 online today for timely submission.

The tax assessment number serves as a reference for local tax authorities to manage property records and assess taxes accurately. It allows property owners to inquire about their tax assessments easily. For detailed insights and clarity regarding your tax assessment, consider utilizing resources like the Form RP-6603-V:2/06:Report Of Total Assessed Value Of Locally ... - Tax Ny.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.