Get Nys Board Of Real Property Services Rp466c Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nys Board Of Real Property Services Rp466c Form online

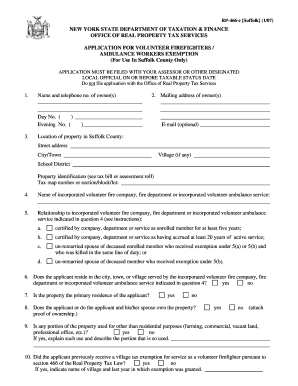

This guide provides clear, step-by-step instructions for completing the Nys Board Of Real Property Services Rp466c Form online. Designed for ease of use, it aims to support users with varying levels of experience in filling out this important application for volunteer firefighters and ambulance workers in Suffolk County.

Follow the steps to successfully complete the Rp466c Form online.

- Click ‘Get Form’ button to obtain the form and access it in your preferred online editing format.

- Begin by entering the name and telephone number of the property owner(s) in the designated fields.

- In the mailing address section, provide the full mailing address of the owner(s), including the email address if available.

- Specify the location of the property in Suffolk County by filling in the street address, city or town, any village, and the school district.

- Identify the property using the tax identification details, including the tax map number or section/block/lot.

- Name the incorporated volunteer fire company, fire department, or incorporated volunteer ambulance service that the applicant is associated with.

- Select the appropriate relationship to the service indicated in the previous step, choosing from the given options regarding service and standing.

- Answer whether the applicant resides in the city, town, or village served by the service organization mentioned earlier.

- Indicate if the property is the applicant's primary residence.

- Confirm ownership of the property by the applicant or jointly with a partner, providing proof of ownership if necessary.

- If applicable, disclose any portion of the property that is used for purposes other than residential.

- Determine if the applicant has previously received a village tax exemption for volunteer service, providing additional details as required.

- Complete the certification section, including the date and necessary signatures of the applicant and spouse, if applicable.

- Upon finalizing the form, save changes, and choose to download, print, or share the completed form as needed.

Start filling out your documents online today to ensure timely submission and access to available exemptions.

Being exempt from New York State income tax withholding means that your income is not subject to state income tax deductions from your paycheck. This status might apply if you qualify under certain exemptions outlined in the NYS Board Of Real Property Services Rp466c Form. It's essential to file this form correctly to maintain your exempt status. If you need assistance with this process, US Legal Forms offers resources to help you navigate the requirements effortlessly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.