Get Nys Form Rp 459

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nys Form Rp 459 online

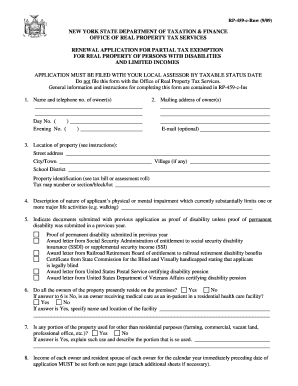

The Nys Form Rp 459 is a renewal application for partial tax exemption for real property owned by persons with disabilities and limited incomes. This guide will provide you with clear, step-by-step instructions on how to complete this form online, ensuring you understand each component as you prepare your application.

Follow the steps to complete the Nys Form Rp 459 online:

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Provide the name and telephone number of the owners in the designated fields. Include both day and evening contact numbers.

- Enter the mailing address of the owners, including any optional email address.

- Input the location of the property by including the street address, city or town, and school district information.

- If applicable, include the village and the property identification details, such as the tax map number or section/block/lot.

- Describe the nature of the applicant’s physical or mental impairment that limits one or more major life activities, providing sufficient detail.

- Indicate any documents submitted with previous applications that prove disability, selecting from the provided options.

- Answer whether all owners of the property currently reside on the premises; if 'No', specify if an owner is receiving medical care and provide facility details.

- Indicate if any portion of the property is used for purposes other than residential and explain such use.

- Report the income of each owner and resident spouse for the previous calendar year, ensuring to follow the table format provided, including sources of income.

- Detail any income amounts used for care in a residential health care facility, attaching proof if necessary.

- Fill out any unreimbursed medical and prescription drug expenses, attaching relevant proofs.

- Confirm if a federal or New York State income tax return was filed for the preceding year, and attach a copy if applicable.

- Answer if any children reside on the property and attend public school, providing details of the school.

- Certify the application by having all owners sign and date the form at the end.

Complete your Nys Form Rp 459 online to ensure you receive the tax exemption benefits available to you.

You can easily pick up New York state tax forms at various locations like public libraries, government offices, or the New York State Department of Taxation and Finance. Many forms are also available for download online, which provides a convenient option. If you're looking for assistance with these forms, the platform U.S. Legal Forms can guide you in accessing necessary forms like the Nys Form Rp 459 and understanding their usage.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.