Get St 100 Form Ending February 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the St 100 form ending February 2013 online

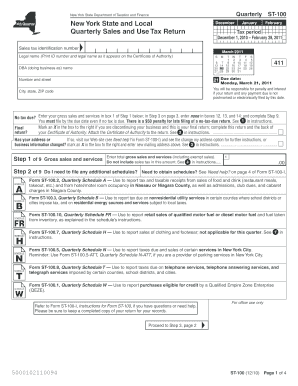

The St 100 Form is a quarterly sales and use tax return required by the New York State Department of Taxation and Finance. This guide provides clear instructions on how to complete the form online, ensuring compliance with state tax regulations.

Follow the steps to successfully complete the St 100 form online.

- Click ‘Get Form’ button to obtain the St 100 Form and open it in your online editor.

- Enter your legal name and sales tax identification number as they appear on your Certificate of Authority. This information is critical for proper identification.

- In Step 1, report your total gross sales and services for the tax period, ensuring you do not include sales tax in this total. This figure will be used to assess your tax liability.

- For Step 2, determine if you need to file any additional schedules. Refer to the provided instructions if applicable. This may include different schedules for specific services or products sold.

- Calculate sales and use taxes in Step 3. Aggregate the totals from relevant schedules and enter them in the appropriate sections of the form.

- In Step 4, calculate any special taxes that may apply to your business operations as highlighted in the form instructions.

- Proceed to Step 5 to calculate tax credits and any advance payments. Make sure to review each section for accuracy and completeness.

- In Step 6, summarize your taxes due by combining the figures from previous steps, ensuring that you apply any applicable credits correctly.

- Complete Step 9 by signing the return, entering your printed name and title, and confirming that your contact information is accurate.

- Finally, review your return for any errors, save your changes, and then download or share the completed form as necessary. Ensure it is mailed by the due date.

Complete your St 100 Form online today to stay compliant with New York State sales tax regulations.

Tax Form 100 is a crucial document used by businesses in New York State to report their annual income and sales tax obligations. The St 100 Form Ending February 2013 falls under this category and is used specifically for reporting sales tax collected during that time. Understanding its purpose will help you stay compliant with tax regulations. If you need help ensuring you are using the correct form, uslegalforms provides useful resources.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.