Loading

Get Print It249 Form 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Print It249 Form 2012 online

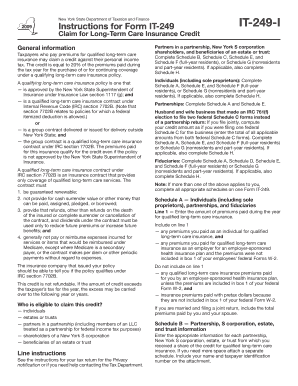

Filling out the Print It249 Form 2012 can be a straightforward process when you follow clear instructions. This guide provides step-by-step assistance to help you accurately complete the form online, ensuring you can claim the long-term care insurance credit with confidence.

Follow the steps to fill out the Print It249 Form 2012 online.

- Click 'Get Form' button to access the Print It249 Form 2012 and open it in your preferred online platform.

- In Schedule A, enter the total amount of premiums you paid for qualified long-term care insurance during the tax year. Include personal payments and employer-sponsored contributions not reported on your W-2 forms.

- If you are part of a partnership, New York S corporation, estate, or trust, complete Schedule B by providing the necessary information about the entities from which you received credits.

- For contributions received from a partnership or corporation, fill out Schedule C, noting your share of the long-term care insurance credit as instructed.

- Complete Schedule H to calculate the application of credit and any carryover if your total credits exceed your tax obligation.

- If applicable, utilize Schedule D to allocate credit divisions among beneficiaries or fiduciaries, based on each individual’s income share.

- Review all entries for accuracy, then proceed to save your changes. You may download, print, or share the completed form as needed.

Begin filling out your Print It249 Form 2012 online today and ensure you claim your eligible long-term care insurance credit.

You cannot generally obtain a copy of your tax return from 10 years ago through the IRS, as they typically provide access for up to six years. However, if you need documents related to tax returns older than that, consider checking local archives or financial institutions. For more recent returns like the Print It249 Form 2012, use Form 4506.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.