Loading

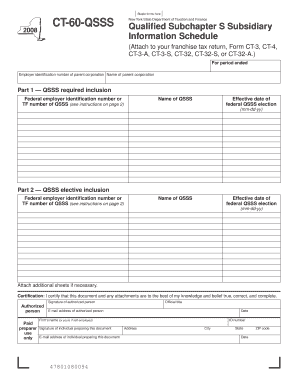

Get Form Ct-60-qsss: 2008 : Qualified Subchapter S Subsidiary ... - Tax Ny

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form CT-60-QSSS: 2008 : Qualified Subchapter S Subsidiary - Tax Ny online

Filling out the Form CT-60-QSSS is an important task for corporations that own qualified subchapter S subsidiaries in New York. This guide will provide you with clear and step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to fill out the Form CT-60-QSSS online.

- Click ‘Get Form’ button to obtain the form and open it for filling.

- Enter the employer identification number of the parent corporation in the designated field. Make sure this number is correct to avoid issues with your filing.

- Provide the name of the parent corporation in the respective field. Ensure the spelling is accurate, as this information is critical for identification.

- In Part 1, fill in the federal employer identification number or TF number of the qualified subchapter S subsidiary (QSSS). If the QSSS does not have an EIN, enter the TF number assigned by the Tax Department.

- Input the name of the QSSS in the corresponding field in Part 1.

- Enter the effective date of the federal QSSS election in the (mm-dd-yy) format. This date is critical for tax purposes.

- If there are multiple QSSSs to report, repeat Steps 4-6 for each QSSS. Utilize additional sheets if necessary.

- In Part 2, repeat the previous steps for QSSSs you elect to include, making sure to provide the necessary information for each.

- Once all applicable information is filled in, proceed to the certification statement. The authorized person must sign and date the form.

- Finalize your document by saving the changes, downloading, printing, or sharing the form as needed.

Complete your documents online with confidence and ensure timely submission of your Form CT-60-QSSS for accurate tax reporting.

In New York, you can fax a certificate of dissolution to the Department of State. Make sure to include relevant details to process your document efficiently. For more guidance on filing and forms like Form CT-60-QSSS: 2008: Qualified Subchapter S Subsidiary ... - Tax Ny, check resources available at uslegalforms to simplify the submission process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.