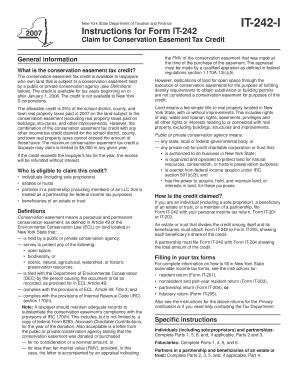

Get Form It-242-i: 2007 :instructions For Form It-242,claim For Conservation - Tax Ny

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form IT-242-I: 2007 :Instructions For Form IT-242, Claim For Conservation - Tax Ny online

Filling out Form IT-242-I can be a straightforward process when you understand the steps involved. This guide offers clear instructions to help users complete the form accurately online, ensuring that you can claim the conservation easement tax credit effectively.

Follow the steps to fill out Form IT-242 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information or the applicable business entity details in Part 1 of the form. Ensure you include your name and either your social security number (SSN) or employer identification number (EIN).

- In Column A, report the allowable real property taxes on the land subject to a conservation easement. This includes the school district, county, and town taxes paid in 2007. Do not include any city or village property taxes or other special charges.

- If you are dividing the land under conservation easement with other individuals, only include your share of the total property taxes paid.

- In Column C, if claiming any other credits that utilize the same taxes reported in Column A, enter the prorated amount for those credits.

- If you are a partner or beneficiary, complete Parts 2 and 3, entering information about your share of the conservation easement tax credit received from partnerships, estates, or trusts.

- Complete Part 4 if applicable, detailing how the credit is allocated among beneficiaries.

- In Part 6, provide identifying details for each conservation easement, including the address of the property, the name of the holding agency, and the recording information.

- Review the entire form for accuracy. If additional space is needed, attach a separate sheet with the same format.

- After completing the form, save your changes, and you can choose to download, print, or share the document as needed.

Start filling out your forms online to ensure you claim your conservation easement tax credit successfully.

To report a conservation easement on your tax return, you will need to complete the appropriate sections of your tax forms, typically involving Form 8283 if you donated the easement. Accurate documentation and adherence to Form IT-242-I: 2007: Instructions For Form IT-242, Claim For Conservation - Tax NY are essential for compliance. Platforms like USLegalForms provide valuable resources to ensure you have the right forms and instructions for this important process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.