Get Form Dtf-620:8/07: Application For Certification Of A Qualified ... - Tax Ny

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form DTF-620:8/07: Application for Certification of a Qualified Emerging Technology Company online

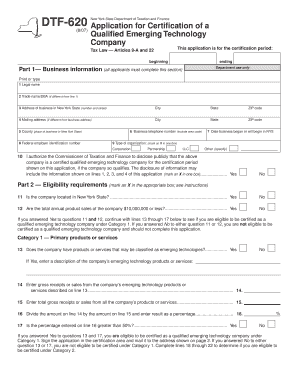

This guide provides step-by-step instructions for completing the Form DTF-620:8/07, the application for certification of a qualified emerging technology company in New York. Following these instructions will help ensure that your application is completed accurately and efficiently.

Follow the steps to complete your application successfully.

- Click ‘Get Form’ button to obtain the form and open it for completion.

- In Part 1, provide the business information. This includes entering the legal name and trade name, if applicable, along with the business address, mailing address (if different), and contact details. Ensure all fields are filled out clearly.

- Indicate the business type by marking an X in the appropriate box for corporation, partnership, LLC, or other. Also, provide the federal employer identification number and the date the business commenced in New York State.

- In the eligibility requirements section (Part 2), answer questions 11 and 12 regarding the company's location and sales revenue. If the answers are both ‘yes’, continue filling out the form.

- Complete Category 1 by answering question 13 about the company's emerging technology products or services. If earlier questions were ‘yes’, provide a description of the products or services.

- Input gross receipts or sales from the emerging technology products in line 14, and total gross receipts in line 15. Calculate the percentage of emerging technology sales using line 16.

- Validate the result from line 16 by answering question 17. If you qualify, proceed to sign the application in the certification area.

- If applicable, answer the questions in Category 2 regarding research and development activities, entering R&D funds in line 19, and net sales in line 20.

- Calculate the R&D funds percentage in line 21 and state whether it meets or exceeds 3.4% in line 22.

- After completing all the relevant sections and verifying your information, save any changes. You can then download, print, or share your completed form.

Ready to get started? Complete your Form DTF-620 online today!

To obtain a copy of your New York state tax return, you need to contact the New York State Department of Taxation and Finance. They can provide you with the necessary forms and information, including any relevant documents like the Form DTF-6/07: Application For Certification Of A Qualified ... - Tax Ny. Using uslegalforms can simplify the process, offering guidance on how to request your tax return efficiently.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.