Get Form Ct 400

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Ct 400 online

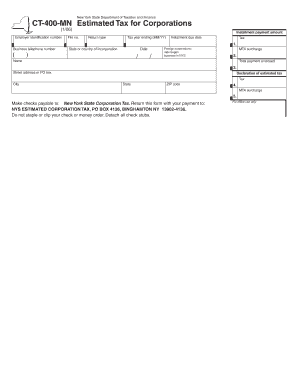

Filling out the Form Ct 400 is an essential step for corporations in New York to declare their estimated tax obligations. This guide provides a clear, step-by-step approach to help you navigate the online form efficiently.

Follow the steps to complete the Form Ct 400.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Enter your employer identification number (EIN) in the designated field. This number is crucial for identifying your corporation with tax authorities.

- Fill in the file number if applicable, which helps track your filing history.

- Specify the installment payment amount and select the return type appropriate for your corporation.

- Indicate the tax year ending by entering the month and year in MM/YY format.

- Enter the installment due date, ensuring it complies with tax regulations.

- Provide the business telephone number, ensuring it includes the area code.

- State or country of incorporation should be filled out accurately to reflect your corporation's registered location.

- Input the date on which your business began operations in New York State if you are a foreign corporation.

- Calculate and enter the MTA surcharge if it applies to your corporation.

- Include the total payment enclosed, summarizing all amounts due.

- Fill out the complete street address or post office box where your corporation receives mail.

- Ensure accurate city, state, and ZIP code entries for the address provided.

- Make checks payable to 'New York State Corporation Tax' and return the form with your payment. Use the specified mailing address: NYS ESTIMATED CORPORATION TAX, PO BOX 4136, BINGHAMTON NY 13902-4136.

- After completing the form, you can save changes, download, print, or share the form as needed.

Ensure your compliance by completing and submitting your Form Ct 400 online today.

To fill out your withholding tax form, carefully read through the instructions provided, gathering all necessary information in advance. Ensure you accurately list your income, deductions, and personal information, confirming that it matches your supporting documents. If complications arise, don't hesitate to consult resources like Form Ct 400, which can provide clarity. Completing this form correctly is important to manage your tax obligations efficiently.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.