Get Ny Cider Tax Return Mt 60 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ny Cider Tax Return Mt 60 Form online

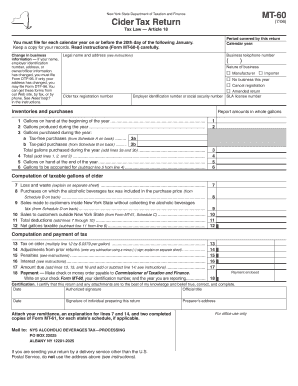

Filling out the Ny Cider Tax Return Mt 60 Form online is essential for complying with New York State tax regulations regarding cider production and sales. This guide provides step-by-step instructions to ensure that you complete the form accurately and efficiently.

Follow the steps to complete the Ny Cider Tax Return Mt 60 Form online.

- Click ‘Get Form’ button to obtain the Ny Cider Tax Return Mt 60 Form and open it in the designated editor.

- Fill in the calendar year for the period covered by this return at the top of the form. Ensure that you file for each calendar year on or before the 20th day of the following January.

- Provide your legal name and address as well as your business telephone number in the designated fields.

- Indicate the nature of your business and your cider tax registration number, if applicable. Select whether you are an importer or manufacturer and specify if you had no business this year, wish to cancel registration, or are submitting an amended return.

- Complete the inventories and purchases section by reporting gallons on hand at the beginning of the year and gallons produced and purchased during the year. Be sure to distinguish tax-free from tax-paid purchases.

- Calculate total gallons purchased and gallons on hand at the end of the year to determine total gallons to be accounted for.

- In the computation of taxable gallons of cider, report any losses and waste. Enter amounts sold to customers inside and outside New York State, and calculate total deductions.

- Determine the net gallons taxable by subtracting total deductions from the total gallons accounted for. On the next line, compute the tax due by multiplying taxable gallons by the tax rate.

- Add any prior adjustments, penalties, and interest as indicated. Calculate the final amount due for your filing.

- Include your payment information, ensuring to make your check or money order payable to the Commissioner of Taxation and Finance. Write your Form MT-60 number, identification number, and the year you are reporting on the payment.

- Certify the return by signing in the appropriate section, indicating the date and your official title.

- After completing the form, remember to save your changes, download a copy for your records, and print or share the completed form as needed.

Complete your Ny Cider Tax Return Mt 60 Form online to ensure compliance with tax regulations and avoid penalties.

Individuals must file a NY nonresident tax return if they earned income from New York sources while living outside the state. This includes wages, rental income, or business income. If this applies to you, it’s important to include the Ny Cider Tax Return Mt 60 Form in your filing to ensure compliance with state tax laws. Using platforms like uslegalforms can help you navigate this process efficiently.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.