Get It 182

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IT-182 online

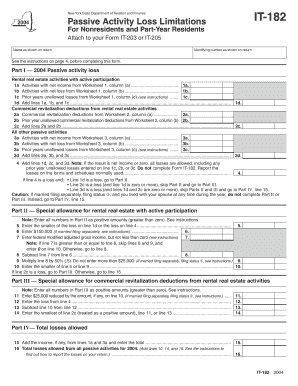

The IT-182 form is essential for nonresidents and part-year residents to report passive activity loss limitations for New York State. This guide will walk you through each section of the form, ensuring that you complete it accurately and efficiently.

Follow the steps to complete the IT-182 form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Enter your name as it appears on your tax return in the designated field at the top of the form.

- Fill in your identifying number, which is also indicated on your tax return. This is crucial for accurate processing.

- Refer to the instructions provided on page 4 of the form before completing the subsequent sections to ensure you fully understand the requirements.

- In Part I, begin by reporting your passive activity losses. Use Worksheet 1 to compile net income (line 1a) and net losses (line 1b) from your rental real estate activities.

- For commercial revitalization deductions, complete Worksheet 2, summarizing deductions from your activities (lines 2a and 2b).

- Utilize Worksheet 3 to detail all other passive activities, entering net income (line 3a), net loss (line 3b), and any prior year losses (line 3c).

- Add the totals from lines 1d, 2c, and 3d to determine your overall passive activity loss. If this number is zero or results in net income, do not proceed with the form.

- If you need to continue, evaluate your losses according to the guidelines in Parts II, III, and IV based on your situation and follow instructions to complete those sections.

- Once all relevant sections are filled out, review your entries for accuracy and completeness. Save your changes, then download, print, or share the form as needed.

Complete your IT-182 form online today to ensure proper reporting of your passive activity losses.

Form 8582 is used to calculate passive activity loss limitations for individuals, estates, and trusts. This form helps taxpayers determine how much of their passive losses can offset their non-passive income. Staying compliant with tax laws is essential, and understanding this form can prevent costly mistakes. For assistance with Form 8582 and related issues, US Legal Forms can be a reliable source.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.