Loading

Get Sla Form 1041

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sla Form 1041 online

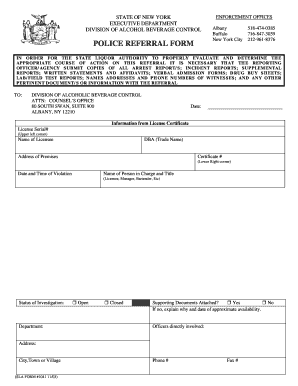

Filling out the Sla Form 1041 online is a straightforward process that requires careful attention to detail. This guide will walk you through each section of the form to ensure that all necessary information is accurately submitted.

Follow the steps to complete the Sla Form 1041 online.

- Press the ‘Get Form’ button to access the form in your preferred editor.

- Enter the date at the top of the form to indicate when the referral is being submitted.

- Locate the 'Information from License Certificate' section. Here, provide the License Serial number, Name of Licensee, and the Doing Business As (DBA) name. Make sure these details match the official records.

- Input the Certificate number found in the lower right corner of your License Certificate.

- Provide the Name of the Person in Charge and their Title, specifying if they are the Licensee, Manager, Bartender, etc.

- Identify the Department involved in the investigation and enter relevant details of any Officers directly involved, including their address, city, town, or village.

- In the 'Supporting Documents Attached?' section, check 'Yes' or 'No' and provide an explanation if 'No' while estimating the availability date of these documents.

- Finally, download, print, or share the completed form as needed.

Start filling out your Sla Form 1041 online today!

To report the sale of a home in a trust, you’ll need to file Form 1041 and report the transaction as part of the trust's income. It's essential to include any gains or losses incurred during the sale. Additionally, Be thorough in documenting all relevant details to ensure compliance with IRS requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.