Get Nys W4 P Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nys W4 P Form online

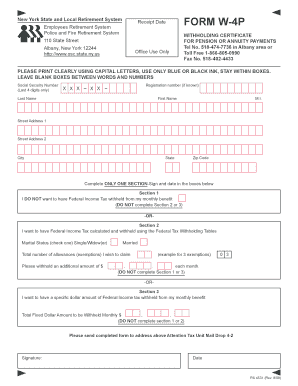

Filling out the Nys W4 P Form correctly is essential for ensuring your federal income tax withholding aligns with your financial situation. This guide provides clear, step-by-step instructions to help you complete the form online, making the process straightforward and efficient.

Follow the steps to complete the Nys W4 P Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your Social Security number. Only the last four digits are required, presented as XXX-XX-.

- Select one of the three sections for tax withholding preferences: Section 1 if you do not wish to have federal income tax withheld, Section 2 if you want tax calculated using Federal Tax Withholding Tables, or Section 3 if you prefer to specify a fixed dollar amount to be withheld monthly.

- If you select Section 3, enter the specific dollar amount you want withheld monthly.

- Once all fields are completed, you may save the changes, download, print, or share the form as needed.

Complete your Nys W4 P Form online today to ensure your tax withholding is managed correctly.

Claiming 0 on the NYS W4 P Form usually results in higher tax withholding, but it is a common misconception that it guarantees you won’t owe more taxes. If your income increases or you have other sources of income that are not taxed, you may still end up owing taxes despite claiming 0. To get a clearer picture, analyzing your overall tax situation and using platforms like uslegalforms can be quite helpful in managing your tax liabilities.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.