Loading

Get 1040 Sirs Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1040 Sirs Forms online

Completing the 1040 Sirs Forms online can simplify your tax filing process. This guide provides step-by-step instructions to ensure that you accurately fill out each section of the form, making tax management easier for all users.

Follow the steps to complete the 1040 Sirs Forms effectively.

- Click ‘Get Form’ button to obtain the 1040 Sirs Forms and open it in the online editor.

- Begin by entering your name(s) as shown on the form. This is critical for identifying your tax records accurately.

- Input your Social Security Number in the designated field to link your identity to your tax records.

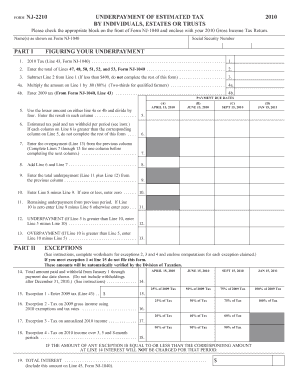

- In Part I, start with Line 1. Enter your total tax from Line 43 of Form NJ-1040. This reflects your overall tax obligation.

- For Line 2, summarize any applicable totals from Lines 47, 48, 50, 51, 52, and 53 of Form NJ-1040 — this includes withholdings and credits.

- Subtract the amount on Line 2 from Line 1 and enter the result on Line 3. If this amount is less than $400, you may not need to proceed with the form.

- For Lines 4a and 4b, calculate your expected payments. Use the figures from Line 1 to determine if you're eligible for exceptions based on your previous year's tax obligation.

- Proceed to the payment due dates section. Make sure to enter estimated tax amounts for the due dates indicated, dividing as necessary.

- Check and record any overpayments or underpayments. These calculations will help you avoid potential interest charges associated with underpaying your taxes.

- Complete Part II if exceptions are applicable. You may need to prepare additional worksheets to verify any exceptions based on specific criteria.

- After preparing all sections, review the entire form for any errors or omissions and make necessary corrections.

- Once you are satisfied with the accuracy of your entries, proceed to save your changes, download or print your completed form, or share it as necessary.

Start filling out your 1040 Sirs Forms online today to streamline your tax process!

For the 2023 tax year, seniors over 65 can benefit from a higher standard deduction that effectively lowers their taxable income. This increased deduction is designed to alleviate some financial burden on older taxpayers, allowing them to retain more of their income. To take advantage of this deduction, consider using the 1040 Sirs Forms to ensure accuracy in your filing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.