Loading

Get Nj 2440 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nj 2440 Form online

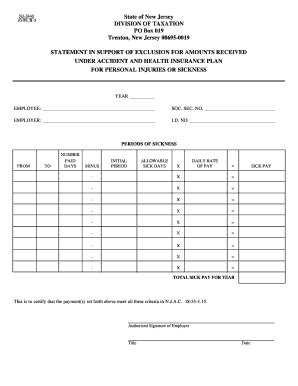

The Nj 2440 Form is used for declaring amounts received under an accident and health insurance plan for personal injuries or sickness. This guide will provide you with clear, step-by-step instructions on how to fill out the form online.

Follow the steps to complete the Nj 2440 Form online effectively.

- Press the ‘Get Form’ button to obtain the Nj 2440 Form and open it in your preferred editor.

- Provide the year in the designated space at the top of the form.

- Enter the employee's name in the section marked 'EMPLOYEE' along with their social security number in the 'SOC. SEC. NO.' field.

- Fill in the employer's name under the 'EMPLOYER' section and include the employer's identification number in 'I.D. NO.'.

- Indicate the periods of sickness by providing the start and end dates in the 'FROM' and 'TO' fields.

- Record the number of paid sick days for each period in the 'NUMBER PAID DAYS' column.

- Deduct the initial period from the number of paid days in 'MINUS INITIAL PERIOD'.

- Calculate the allowable sick days and enter the figures accordingly in 'ALLOWABLE SICK DAYS'.

- Multiply the allowable sick days by the daily rate of pay, entering results in the appropriate sections.

- Sum up the total sick pay for the year in the 'TOTAL SICK PAY FOR YEAR' field.

- The authorized representative of the employer should sign and provide their title and date in the spaces provided.

- Review all the information entered for accuracy. After confirming all details are correct, save the changes or share the completed document as needed.

Complete your Nj 2440 Form online now to ensure timely processing.

Yes, many post offices still carry tax forms, especially during tax season. However, availability may depend on the location, so it is wise to call ahead and check. For a more comprehensive solution, consider directly accessing the Nj 2440 Form from the state's official website.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.