Get Pa-33 - Nh Department Of Revenue Administration - Revenue Nh

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA-33 - NH Department Of Revenue Administration - Revenue Nh online

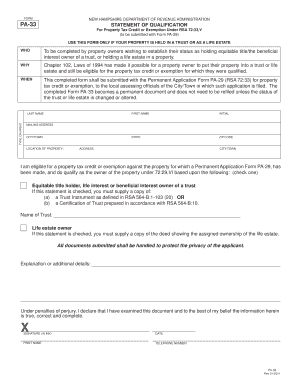

The PA-33 form is essential for property owners in New Hampshire who wish to declare their status for property tax credits or exemptions under specific conditions. This guide provides a clear, step-by-step approach to completing the form online to ensure accuracy and compliance.

Follow the steps to successfully complete the PA-33 form online.

- Click ‘Get Form’ button to access the PA-33 document and open it in an editing environment.

- Begin by entering your last name, first name, and middle initial in the designated fields. Make sure to type clearly and accurately.

- Fill out your state and ZIP code along with your mailing address and city/town where you reside. This information is necessary for identifying your property status.

- Input the location of the property for which you are requesting a tax credit or exemption. Provide the full address, including city/town.

- Indicate your eligibility for a property tax credit or exemption by checking the appropriate box: 'Equitable title holder, life interest or beneficial interest owner of a trust' or 'Life estate owner.'

- If applicable, attach a copy of the required documentation. If you checked the first eligibility option, provide a Trust Instrument or a Certification of Trust as per RSA regulations. If you selected the life estate option, include a copy of the deed showing the assigned ownership.

- In the explanation or additional details section, provide any necessary information that supports your eligibility for the property tax credit or exemption.

- Read carefully the declaration statement under penalties of perjury, then sign and date the form in ink. Ensure that your printed name and telephone number are also included.

- Review all entries for accuracy and completeness. Once satisfied, save your changes, download the finalized form, and print or share it as necessary.

Complete your PA-33 form online today to ensure your property tax credits or exemptions are properly processed.

As of now, there are no official plans for New Hampshire to abolish income tax by 2025. The state has long prided itself on having no state income tax, but future changes in legislation are always possible. For the most reliable updates, you can check in with the PA-33 - NH Department Of Revenue Administration - Revenue Nh for any developments regarding tax policies.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.