Get New Hampshire Form Dp 151

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the New Hampshire Form Dp 151 online

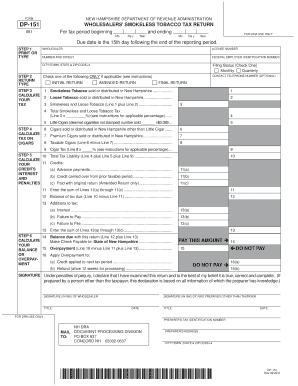

This guide will provide you with step-by-step instructions on how to complete the New Hampshire Form Dp 151 online, specifically designed for wholesalers reporting smokeless tobacco taxes. By following these clear guidelines, you can ensure accurate and efficient filing.

Follow the steps to complete your tax return easily.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by printing or typing your information clearly. Include your wholesaler license number and federal employer identification number. Indicate whether this is a monthly or quarterly return by checking the appropriate box.

- Input the total dollar value of all smokeless tobacco products sold in New Hampshire during the reporting period on Line 1. For loose tobacco, enter the amount on Line 2.

- Calculate the total for smokeless and loose tobacco by adding Lines 1 and 2. Enter this total on Line 3.

- Use the applicable percentage to calculate the total smokeless and loose tobacco tax and enter this on Line 4.

- For Little Cigars, enter the quantity sold on Line 5 and calculate the appropriate tax. Report other cigars on Lines 6 and 7, calculating the taxable cigars for Line 8.

- Calculate the cigar tax on Line 9 based on the applicable tax rate.

- Sum up Lines 4, 5, and 9 to determine your total tax liability, which you will enter on Line 10.

- Calculate any credits you may have on Lines 11(a) to 11(c) and enter the total on Line 11.

- Determine the balance of tax due by subtracting Line 11 from Line 10, which you will report on Line 12.

- Calculate any additions to tax on Lines 13(a), 13(b), and 13(c) and enter the total on Line 13.

- Finally, on Line 14, combine the amounts from Lines 12 and 13 to determine your balance due. If you have overpaid, report this on Line 15, with options for future credits or refunds on Line 16.

- Sign and date the form in ink, ensuring all required signatures are complete before submission.

Complete your New Hampshire Form Dp 151 online today and ensure your tax obligations are met promptly.

Certain individuals, such as low-income earners who do not meet specific thresholds, may not be required to file a return in New Hampshire. Additionally, those who do not derive income from taxable sources may also be exempt. It's important to review your specific circumstances closely, and the New Hampshire Form Dp 151 can guide you through understanding your filing obligations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.