Loading

Get Nh Department Of Revenue And Form Bt Summary

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nh Department Of Revenue And Form Bt Summary online

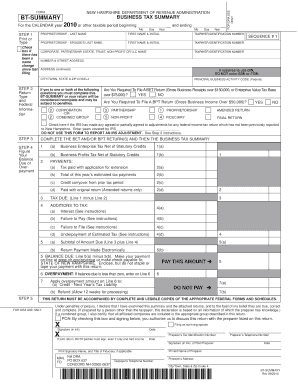

Filing the Nh Department of Revenue and Form BT Summary can seem daunting, but this guide will help you navigate each step of the process online. Whether you’re a business owner or a representative, you will find clear instructions tailored to your needs.

Follow the steps to complete the NH Department of Revenue and Form BT Summary online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Begin by entering the beginning and ending dates of your taxable period. If different from the calendar year, make sure to specify these dates.

- Fill in your name, address, taxpayer identification number (SSN, FEIN, or DIN), and principal business activity code in the designated fields.

- If applicable, complete the section on your spouse’s information as required. Ensure to enter their name and taxpayer identification number accurately.

- Indicate whether you are required to file a Business Enterprise Tax (BET) Return or a Business Profits Tax (BPT) Return by checking the appropriate boxes.

- Fill in the return type, checking boxes for amendments or final filings as necessary. If applicable, provide information for any IRS adjustments made.

- After completing the BET and/or BPT returns, proceed to calculate your balance due or overpayment by following the instructions in the form.

- Ensure you include any statutory credits and report the total tax due after accounting for payments already made.

- Complete the signature section with the necessary signatures, ensuring both parties sign if applicable. If completed by a preparer, their information must also be included.

- Finally, save your changes, then download or print the final document to submit, or share it with the appropriate parties.

Start filling out your NH Department of Revenue and Form BT Summary online today!

To access your tax return summary, go to the NH Department of Revenue website and look for the Form BT Summary section. You may need to enter some identifying information, such as your Social Security number or tax ID. Additionally, uslegalforms can assist you in obtaining and understanding your tax summary with ease.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.