Loading

Get 2009 Pit-x - New Mexico Trd... - Test Trd Newmexico

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2009 PIT-X - New Mexico TRD online

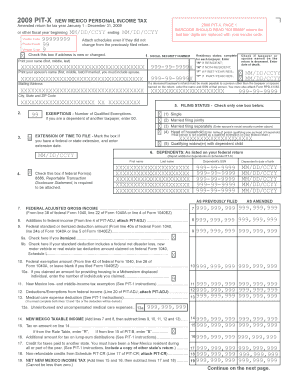

Filling out the 2009 PIT-X form is essential for individuals who need to amend their personal income tax returns in New Mexico. This guide will provide detailed, step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to fill out the form online.

- Click ‘Get Form’ button to access the amendment form and open it in the editor.

- Enter your Social Security Number in the designated field. If your address has changed, check the appropriate box.

- Print your name as it appears on official documents, including your first, middle, and last names.

- If married, you must also print your spouse's name in the corresponding field.

- Provide your mailing address, including city, state, and ZIP code.

- Indicate the number of qualified exemptions by filling out the exemptions section.

- If applicable, mark the box indicating that you have a federal or state extension and enter the extension date.

- Select your filing status by checking one box that accurately describes your situation.

- List your dependents as they appear on your federal return, including their names and Social Security Numbers.

- Complete the residency status for each taxpayer, marking 'R' for resident or 'N' for non-resident appropriately.

- Fill in your federal adjusted gross income as indicated on your federal tax form.

- Complete the lines for any additions to federal income and enter your federal standard or itemized deductions.

- Enter your New Mexico taxable income, which is calculated by adding certain lines and subtracting others.

- Input tax amounts and complete calculations for credits and payments, ensuring to attach any necessary schedules.

- Check all fields for accuracy and completeness before proceeding.

- Upon completion, save your changes, then download or print your amended return for your records.

- Lastly, submit the original form to the New Mexico Taxation and Revenue Department by the designated deadline.

Complete your 2009 PIT-X form online today to ensure compliance and accuracy.

The New Mexico PIT-B tax applies to certain taxpayers, including businesses and individuals who report specific types of income. This form is designed to capture detailed income data and applicable deductions. Understanding the PIT-B tax model ensures proper filing and compliance with New Mexico state tax requirements, especially when addressing the 2009 PIT-X.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.