Loading

Get Rpd 41286 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rpd 41286 Form online

Filling out the Rpd 41286 Form online is a straightforward process that requires careful attention to detail. This guide will walk you through each section of the form, ensuring that you complete it accurately and efficiently.

Follow the steps to complete the Rpd 41286 Form online

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

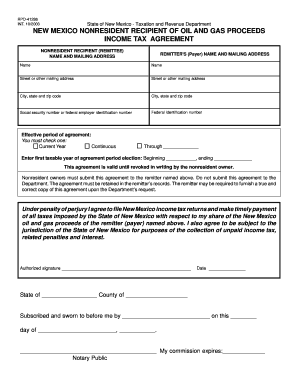

- Begin by entering your name and mailing address in the designated fields for the nonresident recipient. Ensure that all information is accurate and matches your official documents.

- Next, provide the remitter's (payer) name and mailing address. It is important to check that all details are correct as this information is crucial for tax documentation.

- Input the social security number or federal employer identification number, along with the federal identification number for the remitter. Double-check these numbers for accuracy.

- Select the effective period of the agreement by checking the appropriate option: 'Current Year' or 'Continuous.' If selecting a specific period, enter the start and end dates in the spaces provided.

- Acknowledge the validity of the agreement by signing in the authorized signature field. Also, enter the date of signing.

- If required, complete the notary section by providing the necessary information, including state and county, and the name of the notary public. This step ensures that your submission is legally valid.

- Finally, save changes, and you can download, print, or share the completed form as needed. Remember not to submit the form to the Department but keep it with the remitter’s records instead.

Complete your documents online today for a seamless experience.

In New Mexico, the filing frequency for GRT varies depending on your business's gross revenue. Most businesses must file monthly, while others can file quarterly or annually. Understanding your filing frequency is crucial in maintaining compliance, especially when completing the Rpd 41286 Form to ensure you are reporting accurately and on time.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.