Loading

Get Nd Form 38

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nd Form 38 online

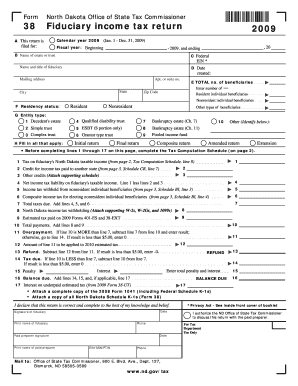

The Nd Form 38 is essential for fiduciary income tax returns in North Dakota. This guide provides clear, detailed instructions to assist users in completing the form online with confidence.

Follow the steps to successfully complete the Nd Form 38 online

- Click ‘Get Form’ button to access the form and open it for editing.

- Indicate the tax year for which the return is filed by selecting the appropriate option in Section A. Make sure the date created matches the tax year chosen.

- In Section B, provide the name of the estate or trust and its Federal Employer Identification Number (EIN) in the respective fields.

- Complete Section C by entering the date, mailing address, and contact information of the fiduciary responsible for the return.

- In Section E, specify the total number of beneficiaries and categorize them as resident or nonresident individual beneficiaries.

- Select the residency status in Section F, either as a resident, nonresident, or other type of beneficiary.

- In Section G, identify the entity type, selecting the appropriate option that describes the fiduciary's structure.

- Complete Section H by marking all applicable options regarding the return type such as initial, final, composite, or amended return.

- Before completing lines 1 through 17, fill out the Tax Computation Schedule on page 2 of the form for tax calculation details.

- Follow the detailed instructions provided in the Tax Computation Schedule to determine the fiduciary's taxable income and calculate the tax liability.

- Fill out any additional lines for credits, payments, or overpayment as applicable based on your tax calculation results.

- Finally, review all entries for accuracy. Once complete, you can save changes, download, print, or share the form as needed.

Complete your fiduciary income tax return confidently by filling out the Nd Form 38 online today.

To avoid probate in North Dakota, you can use strategies like establishing living trusts, holding assets jointly, or designating beneficiaries. These methods can simplify asset transfer upon your passing, avoiding lengthy court processes. Utilizing legal resources, such as those offered by uslegalforms, can assist you in setting up these arrangements effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.