Get F10983 Tiaa Cref Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the F10983 Tiaa Cref Form online

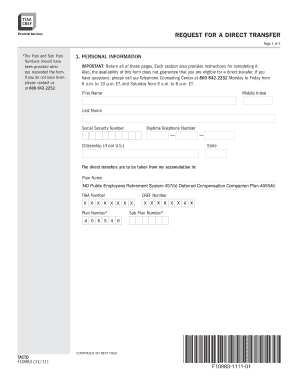

Filling out the F10983 Tiaa Cref Form online is a straightforward process that enables users to request a direct transfer of their retirement funds. This guide provides clear steps to assist you in successfully completing the form.

Follow the steps to fill out the F10983 Tiaa Cref Form online.

- Press the ‘Get Form’ button to obtain the F10983 Tiaa Cref Form and open it in your chosen editor.

- Enter your personal information in Section 1. This includes your first name, middle initial, last name, Social Security number, daytime telephone number, and citizenship status. Ensure that all details are accurate.

- In Section 2, indicate the amount you'd like to transfer. Choose between transferring all available funds or specific amounts by filling in the respective account numbers and amounts or percentages you wish to transfer.

- Complete Section 3 with the investment company information that will receive the transfer. Fill in the company's name, address, city, state, zip code, contact phone number, and any account numbers associated with the transfer.

- Sign and date the form in Section 4. By signing, you authorize TIAA-CREF to process the transfer. Make sure the date entered is accurate and formatted correctly.

- Once you have filled out all sections and confirmed your entries, save your changes. You can then download, print, or share the completed form as necessary.

Complete your F10983 Tiaa Cref Form online today for a seamless transfer process.

TIAA-CREF underwent a significant rebranding in recent years, simplifying its name to TIAA. This change reflects the organization's broader focus on investment services for retirement and education while retaining its commitment to its original mission. If you need to access your tax-related information following this change, you may find the F10983 Tiaa Cref Form helpful. Explore US Legal Forms to ensure you have the correct documentation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.