Loading

Get Mo 8453 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO 8453 Form online

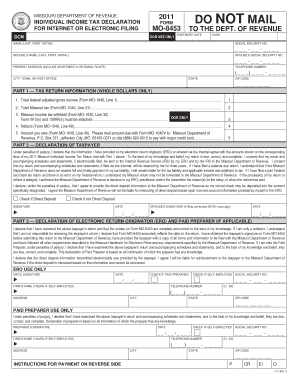

The MO 8453 Form is a crucial document for individuals filing their Missouri state income tax electronically. This guide provides step-by-step instructions tailored to assist users in accurately completing this form online, ensuring a seamless filing experience.

Follow the steps to complete the MO 8453 Form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your full name (last, first, initial) in the designated field, ensuring accuracy to match your identification documents.

- Input your social security number in the specified format (___-__-____), making sure to avoid any errors.

- If applicable, enter your spouse’s name and social security number following the same format as your own.

- Provide your present address, including apartment number or rural route details, in the respective fields, and include your telephone number.

- In Part 1, fill in the total federal adjusted gross income from Form MO-1040, Line 1, specifying amounts in whole dollars only.

- Continuing in Part 1, enter the total Missouri tax from Form MO-1040, Line 31.

- Input the Missouri income tax withheld from Form MO-1040, Line 32, and ensure to attach the necessary Form W-2(s) and 1099R(s).

- Complete the refund amount from Form MO-1040, Line 46, and the amount you owe from Line 49, if applicable.

- In Part 2, check the appropriate box for direct deposit and sign the form along with your spouse’s signature if filing jointly.

- In Part 3, if applicable, ensure the Electronic Return Originator (ERO) signs and completes their section accurately.

- Review all entries for accuracy, save changes to your document, and utilize your options to download, print, or share the completed form as needed.

Complete your MO 8453 Form online today for efficient tax filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The Mo 8453 Form acts as a crucial electronic signature document for e-filers. It confirms that you consent to the IRS using your electronic signature and agrees to the filing of your tax return. Understanding its role in your tax filing can help avoid issues with the IRS. For further clarity, explore resources from uslegalforms to enhance your understanding of its importance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.