Loading

Get Mo 1120 Fillable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mo 1120 Fillable Form online

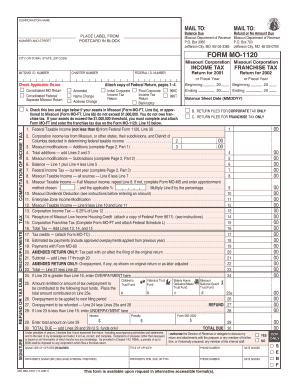

The Mo 1120 Fillable Form is an essential document for corporations filing tax returns in Missouri. This guide provides clear, step-by-step instructions to help users complete the form confidently and accurately online.

Follow the steps to successfully fill out the Mo 1120 Fillable Form.

- Click the ‘Get Form’ button to obtain the form and open it in the designated editor for editing.

- Fill in the corporation name at the top of the form accurately, ensuring it matches the official registration.

- Enter the number and street address of the corporation. Include the city or town, state, and ZIP code in the appropriate fields.

- Locate the boxes for indicating any applicable statuses—check all that are relevant, such as initial corporate income tax return, final return, or if you are filing an amended return.

- Provide the MITS/MO ID number, charter number, and federal ID number in the respective fields to ensure proper identification.

- Complete the sections for income tax computation. Start with the federal taxable income and follow through on the calculations for Missouri modifications as directed.

- After completing each section, carefully review each entry to ensure all information is accurate and complete.

- Once all fields are filled out and verified, you can save changes, download, or print the completed form as needed, or share it as required.

Begin filling out your Mo 1120 Fillable Form online today to ensure compliance and timely submission.

The Mo tax extension form is designed to allow taxpayers extra time to file their state tax returns. It grants an extension for filing using the Mo 1120 Fillable Form, helping ensure you meet state tax obligations without penalty. Typically, you must file the extension form before your original due date. You can find resources and forms on platforms like US Legal Forms to assist with this process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.