Loading

Get Mo 1040a Fillable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Mo 1040a Fillable Form online

Filling out the Mo 1040a Fillable Form online can simplify your tax filing process. This guide provides you with step-by-step instructions to complete each section of the form effectively and accurately, ensuring a smooth experience.

Follow the steps to fill out the Mo 1040a Fillable Form online

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

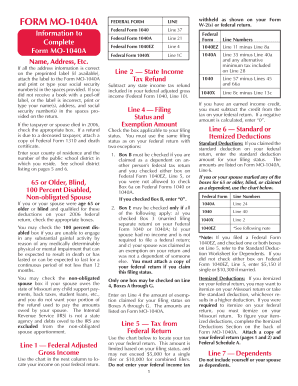

- Review the preprinted label, if available, and ensure all address information is correct. If correct, attach the label and enter your social security number(s). Otherwise, manually type your name, address, and social security number(s). If applicable, indicate if a taxpayer or spouse has passed away, and provide relevant documents if claiming a refund for a deceased individual.

- Indicate your county of residence and select the public school district number where you live from the provided list.

- Check the appropriate boxes if you or your spouse are 65 or older, blind, certified as 100 percent disabled, or a non-obligated spouse.

- For Line 1, record your federal adjusted gross income based on your federal return.

- On Line 2, subtract any state income tax refund included in your federal adjusted gross income.

- Choose your filing status on Line 4 and enter the corresponding exemption amount.

- For Line 5, identify your tax amount based on your federal return and apply any earned income credit, if applicable.

- Complete Line 6 by entering either your standard or itemized deductions as applicable.

- On Line 7, calculate and enter the total number of dependents claimed on your federal return, multiplying by the designated amount.

- If applicable, complete Line 8 for long-term care insurance deductions.

- Proceed to Lines 11 through 19 to calculate tax and indicate any refunds or amounts due based on your inputs.

- Sign and date the form, and ensure both spouses sign if filing jointly.

- Review all required attachments, including W-2 forms or 1099 forms, and ensure they are included with your submission.

- Once satisfied, save changes, download for your records, print, or share the completed form as needed.

Start filling out your Mo 1040a Fillable Form online today for an efficient tax filing experience!

Missouri Form 1040 – Personal Income Tax Return for Residents.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.