Get 2015 1040cr Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2015 1040cr Forms online

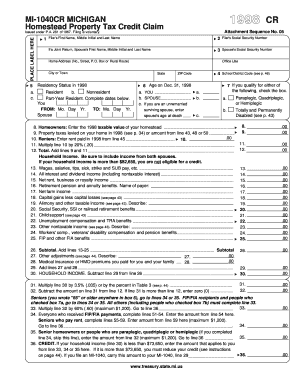

The 2015 1040cr Forms are essential for claiming the Homestead Property Tax Credit in Michigan. This guide offers detailed, step-by-step instructions for completing the form online, ensuring users can navigate the process effectively.

Follow the steps to complete your 2015 1040cr Forms online.

- Press the ‘Get Form’ button to access the 2015 1040cr Forms and open it in your document editor.

- Begin by entering your personal information, including your full name and social security number in the designated fields.

- Provide your home address, including the ZIP code, to ensure accurate location identification for your claim.

- Indicate your age and your partner's age on the specified lines to determine eligibility for senior credits.

- Fill in the school district code based on your residential area as instructed on the form.

- Complete the household income section, including all relevant sources of income such as wages, pensions, and any other taxable income.

- For homeowners, report the taxable value of your homestead and property taxes levied on your home in 2015.

- Renters should enter their total rent paid for 2015 in the designated section on the form.

- If applicable, provide information about any adjustments, including medical insurance costs or other specified deductions.

- Review your entries for accuracy, ensuring all information reflects your current situation and intentions.

- Lastly, save your changes, and proceed to download, print, or share the completed form as needed.

Complete your 2015 1040cr Forms online today to secure your property tax credit!

Yes, you can file your 2019 taxes in 2024, but do note that you may not be eligible for a refund if you file too late. Generally, the IRS allows a three-year window for claiming refunds, which means filing early can save you from missing out on potential benefits. If you happen to have missed the chance to file, make sure to gather all necessary paperwork to complete your 2015 1040CR Forms correctly. Don't hesitate to seek help if you need clarity.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.