Loading

Get Mi Form 4700 Instructions 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mi Form 4700 Instructions 2011 online

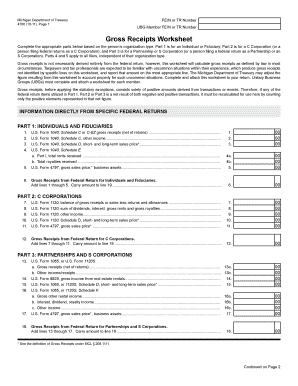

Filling out the Mi Form 4700 can appear complex, but with a clear understanding of each section and field, you can complete it efficiently online. This guide provides step-by-step instructions to help you navigate the form effectively.

Follow the steps to complete the Mi Form 4700 accurately.

- Press the ‘Get Form’ button to retrieve the Mi Form 4700 and open it in your preferred online editor.

- Begin with Part 1, specifically for individuals and fiduciaries. Enter gross receipts from U.S. Form 1040, Schedule C or C-EZ, and any other relevant income on the corresponding lines.

- For C Corporations, move to Part 2. Fill in the required gross receipts from U.S. Form 1120 and any necessary adjustments in the designated fields.

- In Part 3, for partnerships and S Corporations, input gross receipts derived from U.S. Form 1065 and relevant income as outlined. Ensure all data aligns with your federal return.

- Proceed to Part 4 to make any necessary additions to your gross receipts based on specific criteria outlined in the form.

- In Part 5, identify any exclusions from gross receipts, ensuring all entries reflect your financial activities accurately.

- Once each part is filled out, double-check the entries for accuracy. Save your changes regularly to avoid data loss.

- After completing the form, you can download, print, or share the document as required before submission.

Complete the Mi Form 4700 online to fulfill your tax obligations efficiently.

While post offices typically do not carry tax forms, they may offer some basic IRS documents during tax season. However, for specific forms, such as those required for Michigan taxes or Mi Form 4700 Instructions 2011, it’s best to check with local libraries or the department of revenue. This ensures you have everything you need to file your taxes correctly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.