Get Raffle Ticket Accountability Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Raffle Ticket Accountability Form online

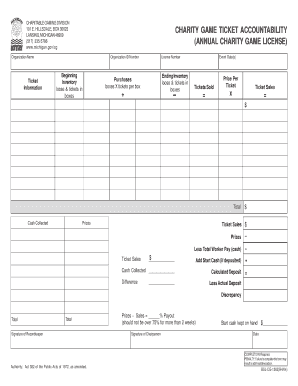

Filling out the Raffle Ticket Accountability Form online is a straightforward process that ensures compliance with charitable gaming regulations. This guide provides step-by-step instructions to help you complete each section accurately.

Follow the steps to complete the Raffle Ticket Accountability Form online

- Press the ‘Get Form’ button to access the Raffle Ticket Accountability Form and open it in your document editor.

- In the 'Organization Name' field, enter the official name of your organization. Ensure that the name matches the one on your license.

- Enter your 'Organization ID Number' as provided by the relevant authorities. This number is essential for record-keeping and compliance.

- Fill in the 'License Number' field with your current charity game license number. This allows for verification of your organization's authorization to conduct fundraising activities.

- Record your 'Beginning Inventory' of both loose tickets and tickets in boxes. This should reflect the starting amount prior to your sales event.

- Indicate your 'Ending Inventory' of loose and boxed tickets after the event. This helps in accounting for all tickets distributed.

- Calculate the total number of 'Purchases' by multiplying the number of boxes by the tickets per box. Insert this total into the designated field.

- Enter the 'Event Date(s)' for the charitable event associated with this ticket sale. Accurate dates are important for record tracking.

- Input the total 'Tickets Sold' during your event. This figure must reflect all tickets that were successfully sold.

- Fill in the 'Price Per Ticket' to denote how much each ticket was sold for during the event.

- Calculate 'Ticket Sales' by multiplying the number of tickets sold by the price per ticket and enter this amount.

- Record the 'Total Cash Collected' from ticket sales, which should equal the figure calculated for ticket sales.

- Detail the total 'Prizes' awarded during the event to ensure accurate reporting on the distribution of earnings.

- Determine and enter 'Less Total Worker Pay (cash)' if any cash payments were made to workers involved in the event.

- If applicable, add any 'Start Cash' that was kept on hand during the event. This amount should be recorded clearly.

- Once all entries are completed, check your calculations for 'Calculated Deposit' and 'Difference'. Ensure everything is accurate.

- Add your signature in the 'Signature of Recordkeeper' field, confirming the accuracy of the information entered.

- Place the 'Signature of Chairperson' for validation, which should be done by the authorized person overseeing the event.

- Finally, review the entire form for completeness. Save changes, download, print, or share the form as needed.

Complete your Raffle Ticket Accountability Form online today to ensure compliance and accountability for your charitable events.

In California, organizations must obtain a raffle registration from the Department of Justice before conducting a raffle. It's important to adhere to set guidelines, such as limiting ticket sales to no more than $5 per ticket and ensuring that proceeds benefit a charitable purpose. Following these rules can simplify your Raffle Ticket Accountability Form and help you maintain compliance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.