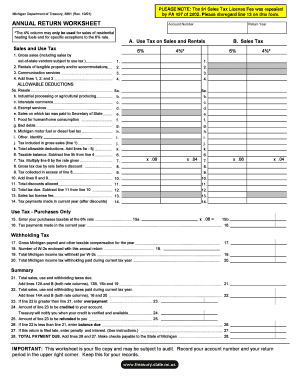

Get Form 3861, Annual Return Worksheet - Michigan

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out and sign Form 3861, Annual Return Worksheet - Michigan online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:The era of daunting and intricate tax and legal paperwork has concluded. With US Legal Forms, the process of generating legal documents is stress-free. The finest editor is right at your fingertips, offering you a broad range of helpful tools for submitting a Form 3861, Annual Return Worksheet - Michigan. These guidelines, along with the editor, will support you throughout the entire procedure.

We streamline the completion of any Form 3861, Annual Return Worksheet - Michigan. Utilize it now!

- Click on the orange Get Form button to begin editing and improving.

- Activate the Wizard mode in the upper toolbar to receive additional suggestions.

- Complete every fillable section.

- Verify that the information you enter into the Form 3861, Annual Return Worksheet - Michigan is current and precise.

- Add the date to the document using the Date feature.

- Press the Sign button to create an electronic signature. You have three options: typing, drawing, or uploading one.

- Double-check that each field has been filled out correctly.

- Click Done in the upper right corner to export the document. There are multiple choices for receiving the file: as an instant download, an attachment in an email, or via postal mail as a hard copy.

Tips on how to fill out, edit and sign Form 3861, Annual Return Worksheet - Michigan online

How to fill out and sign Form 3861, Annual Return Worksheet - Michigan online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

The era of daunting and intricate tax and legal paperwork has concluded. With US Legal Forms, the process of generating legal documents is stress-free. The finest editor is right at your fingertips, offering you a broad range of helpful tools for submitting a Form 3861, Annual Return Worksheet - Michigan. These guidelines, along with the editor, will support you throughout the entire procedure.

We streamline the completion of any Form 3861, Annual Return Worksheet - Michigan. Utilize it now!

- Click on the orange Get Form button to begin editing and improving.

- Activate the Wizard mode in the upper toolbar to receive additional suggestions.

- Complete every fillable section.

- Verify that the information you enter into the Form 3861, Annual Return Worksheet - Michigan is current and precise.

- Add the date to the document using the Date feature.

- Press the Sign button to create an electronic signature. You have three options: typing, drawing, or uploading one.

- Double-check that each field has been filled out correctly.

- Click Done in the upper right corner to export the document. There are multiple choices for receiving the file: as an instant download, an attachment in an email, or via postal mail as a hard copy.

How to modify Get Form 3861, Annual Return Worksheet - Michigan: tailor forms online

Streamline your document preparation process and modify it to your specifications with just a few clicks. Complete and authorize Get Form 3861, Annual Return Worksheet - Michigan using a thorough yet intuitive online editor.

Handling paperwork is always tedious, especially when you manage it sporadically. It requires you to strictly follow all the protocols and accurately fill in all fields with complete and precise data. However, it frequently happens that you need to modify the form or add extra fields to complete. If you wish to enhance Get Form 3861, Annual Return Worksheet - Michigan before submission, the most efficient method to achieve this is by utilizing our thorough yet easy-to-navigate online editing tools.

This comprehensive PDF editing tool allows you to swiftly and effortlessly complete legal documents from any internet-enabled device, make essential modifications to the template, and add additional fillable sections. The service lets you designate a specific area for each type of data, such as Name, Signature, Currency, and SSN, etc. You can set these as mandatory or conditional and determine who should fill each field by assigning them to a specified recipient.

Follow the steps below to enhance your Get Form 3861, Annual Return Worksheet - Michigan online:

Our editor is a flexible, feature-rich online solution that can assist you in rapidly and effortlessly adjusting Get Form 3861, Annual Return Worksheet - Michigan and other templates according to your needs. Enhance document preparation and submission time, ensuring your forms appear impeccable without any hassle.

- Access the desired sample from the catalog.

- Complete the spaces with Text and apply Check and Cross tools to the tick boxes.

- Utilize the right-side panel to modify the template with new fillable sections.

- Choose the fields based on the type of information you wish to gather.

- Set these fields as required, optional, or conditional and personalize their order.

- Delegate each field to a specific party using the Add Signer tool.

- Verify that you’ve made all the necessary changes and click Done.

You can find tax forms and booklets at local libraries, post offices, and online through the Michigan Department of Treasury's website. USLegalForms also provides access to an extensive library of tax forms, including the Form 3861, Annual Return Worksheet - Michigan, making it simple to locate the materials you need for your tax preparation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.