Get Form 154

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 154 online

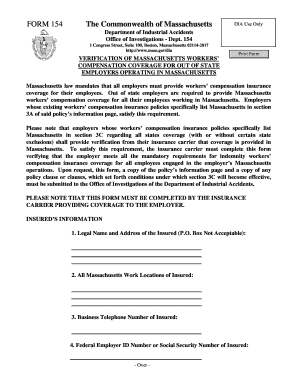

Filling out the Form 154 is essential for out-of-state employers to verify their workers' compensation coverage in Massachusetts. This guide will provide you with clear, step-by-step instructions to help you complete the form online efficiently.

Follow the steps to complete Form 154 accurately

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the legal name and address of the insured in the specified fields, ensuring no P.O. Box is used as it is not acceptable.

- List all Massachusetts work locations of the insured, providing a complete account to satisfy verification requirements.

- Input the business telephone number of the insured to provide a point of contact.

- Fill in the Federal Employer Identification Number (FEIN) or the Social Security Number of the insured to identify the business.

- The next section requires details about the insurance carrier. Start by noting the name of the insurance carrier.

- Provide the name, address, and telephone number of the insurance carrier's contact person for further communication.

- Input the policy number associated with the insured to link the coverage correctly.

- Indicate the policy term to establish the duration of the coverage.

- List the names of the proprietor, all partners, or all officers of the insured, and check the appropriate box indicating their coverage status.

- Review all information for accuracy and ensure each field is completed according to the requirements.

- Finalize the form by having it signed by the insurance carrier representative, who must also provide their title.

- After completing the form, you can save your changes, download a copy for your records, print it, or share it as needed.

Complete your Form 154 online today to ensure compliance with Massachusetts workers' compensation requirements.

An EEOC right-to-sue letter is a formal document that grants you permission to file a lawsuit against your employer after completing the EEOC process. The letter typically includes your case number, the date it was issued, and a statement indicating you have the right to take legal action. If you use Form 154, it can support your case by providing necessary information about your EEOC complaint. This letter is vital because it shows you have exhausted administrative remedies before moving forward with legal proceedings.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.