Loading

Get Form M 8453p Filing Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form M 8453p Filing Instructions online

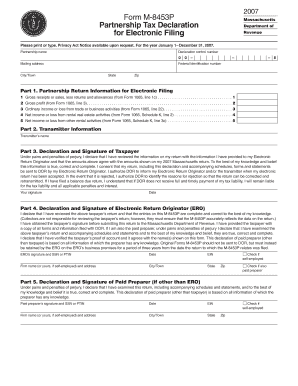

Filling out the Form M 8453p is essential for partnership tax declarations for electronic filing in Massachusetts. This guide provides a clear, step-by-step approach to successfully complete this form online.

Follow the steps to complete the Form M 8453p effectively.

- Press the ‘Get Form’ button to download the form and open it in the online editor.

- Enter the partnership name in the designated field at the top of the form.

- Provide the declaration control number, which is necessary for tracking your submission.

- Fill in the mailing address of the partnership, ensuring that all components such as city, state, and zip code are correctly completed.

- Input the federal identification number as required in the form, ensuring accuracy.

- Move to Part 1, where you will report the partnership return information for electronic filing, including: gross receipts or sales, gross profit, ordinary income or loss, net income or loss from rental real estate, and net income or loss from other rental activities as applicable.

- In Part 2, provide the transmitter's name to ensure proper communication regarding your filing.

- Proceed to Part 3, where you will declare and sign the form, confirming the information is true and complete. Include your signature and the date.

- If applicable, complete Part 4 by having the Electronic Return Originator review and sign the form, including their signature and identification details.

- In Part 5, if there is a paid preparer other than the ERO, ensure they fill out their information, declare their review, and sign the form.

- Once all sections are completed, save your changes, and prepare to download, print, or share the form as needed.

Complete your documents online today and ensure your partnership tax declaration is filed accurately.

Whether you need to mail Form 8453 depends on your specific tax situation. If TurboTax or any tax software prompts you to send this form, it is crucial to follow the guidance provided. The Form M 8453p Filing Instructions help ensure your e-filed return is recognized and processed by the IRS. Failing to do so may cause delays or issues with your tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.