Loading

Get Ma Schedule C

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ma Schedule C online

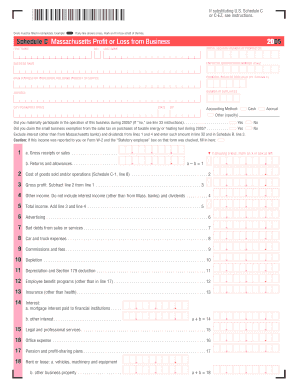

The Ma Schedule C, also known as the Massachusetts Profit or Loss from Business form, is essential for reporting income and expenses for sole proprietors. This guide provides a comprehensive, step-by-step approach to filling out this form online, ensuring you have the necessary information to complete it accurately.

Follow the steps to fill out the Ma Schedule C online successfully.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Fill in your first name, middle initial, and last name in the designated fields.

- Enter your social security number in the appropriate section.

- Provide your business name and employer identification number, if applicable.

- Indicate your main business or profession, including the products or services offered.

- Specify your principal business code as required from the U.S. Schedule C.

- Complete your business address, including street address, city, state, and ZIP code.

- Note the number of employees working in your business.

- Select your accounting method from the options: Cash, Accrual, or Other (provide specification if necessary).

- Indicate whether you materially participated in the operation of your business during the tax year.

- State if you claimed the small business exemption from sales tax on energy purchases.

- Report your gross receipts or sales in line 1, and enter any returns and allowances in line 1b.

- Calculate your gross profit by subtracting line 2 (cost of goods sold and/or operations) from line 1 (a - b).

- Fill in any other income not included in interest or dividends on line 4.

- Calculate total income by adding line 3 to line 4, then record the result in line 5.

- Proceed to list your business expenses, detailing each in lines 6 through 26, including advertising, legal services, rent, and utilities.

- Total your expenses in line 27 by adding all individual expenses.

- Determine your tentative profit or loss in line 28 by subtracting total expenses from total income.

- If applicable, detail any expenses for business use of your home in line 29.

- If you are claiming the abandoned building renovation deduction, enter that in line 30.

- Compute your net profit or loss by subtracting lines 29 and 30 from line 28, and enter the result in line 31.

- Review and ensure accuracy of your entries before finalizing the form.

- Once completed, save your changes, download the document, and consider printing or sharing as necessary.

Complete your Ma Schedule C online today to ensure accurate and timely reporting of your business income and expenses.

There is no specific minimum income threshold to file a Schedule C; even small earnings can require reporting. If your net earnings exceed $400, you must file. Knowing this can help you stay compliant with tax laws as you prepare your Ma Schedule C.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.