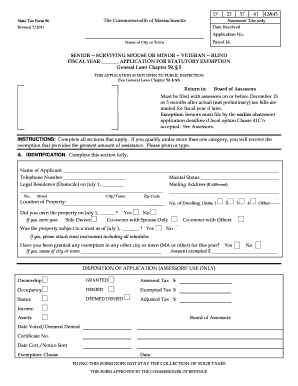

Get State Tax Form 96 - Mass.gov - Mass

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign State Tax Form 96 - Mass.Gov - Mass online

How to fill out and sign State Tax Form 96 - Mass.Gov - Mass online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Have you been trying to find a quick and efficient solution to fill in State Tax Form 96 - Mass.Gov - Mass at an affordable price? Our platform will provide you with a rich selection of templates available for completing on the internet. It only takes a couple of minutes.

Follow these simple actions to get State Tax Form 96 - Mass.Gov - Mass completely ready for submitting:

- Choose the form you will need in our library of legal templates.

- Open the template in our online editor.

- Read the instructions to learn which information you need to give.

- Click the fillable fields and include the required info.

- Put the date and insert your e-autograph as soon as you fill out all other boxes.

- Look at the document for misprints and other mistakes. In case there?s a necessity to change some information, our online editor as well as its wide range of instruments are ready for your use.

- Download the new document to your device by clicking Done.

- Send the e-form to the parties involved.

Submitting State Tax Form 96 - Mass.Gov - Mass doesn?t need to be complicated anymore. From now on easily cope with it from your home or at your place of work right from your smartphone or personal computer.

How to modify State Tax Form 96 - Mass.Gov - Mass: customize forms online

Finishing paperwork is easy with smart online instruments. Eliminate paperwork with easily downloadable State Tax Form 96 - Mass.Gov - Mass templates you can modify online and print.

Preparing documents and forms should be more accessible, whether it is a daily part of one’s job or occasional work. When a person must file a State Tax Form 96 - Mass.Gov - Mass, studying regulations and guides on how to complete a form correctly and what it should include might take a lot of time and effort. Nevertheless, if you find the right State Tax Form 96 - Mass.Gov - Mass template, finishing a document will stop being a struggle with a smart editor at hand.

Discover a wider selection of functions you can add to your document flow routine. No need to print, fill out, and annotate forms manually. With a smart modifying platform, all of the essential document processing functions are always at hand. If you want to make your work process with State Tax Form 96 - Mass.Gov - Mass forms more efficient, find the template in the catalog, select it, and discover a less complicated method to fill it in.

- If you want to add text in a random area of the form or insert a text field, use the Text and Text field instruments and expand the text in the form as much as you need.

- Utilize the Highlight instrument to stress the important parts of the form. If you want to cover or remove some text pieces, utilize the Blackout or Erase instruments.

- Customize the form by adding default graphic elements to it. Use the Circle, Check, and Cross instruments to add these components to the forms, if required.

- If you need additional annotations, utilize the Sticky note tool and place as many notes on the forms page as required.

- If the form requires your initials or date, the editor has instruments for that too. Reduce the possibility of errors using the Initials and Date instruments.

- It is also possible to add custom visual elements to the form. Use the Arrow, Line, and Draw instruments to customize the file.

The more instruments you are familiar with, the better it is to work with State Tax Form 96 - Mass.Gov - Mass. Try the solution that provides everything required to find and modify forms in a single tab of your browser and forget about manual paperwork.

income. Every person whose estimated tax liability for the year is ₹10,000 or more, is liable to pay advance tax. However, a senior citizen need not to pay any advance tax, provided he does not have any income under the head "Profits and Gains of Business or Profession".

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.