Loading

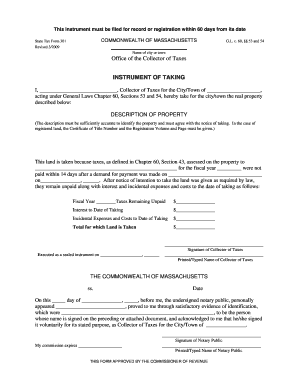

Get Instrument Of Taking - Mass.gov - Mass

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Instrument Of Taking - Mass.Gov - Mass online

The Instrument Of Taking is a crucial document for recording tax-related actions concerning real property in Massachusetts. This guide provides step-by-step instructions to help users navigate the process of filling out this form online with clarity and ease.

Follow the steps to complete the Instrument Of Taking form online.

- Click the ‘Get Form’ button to obtain the Instrument Of Taking form, which will then be opened for your editing.

- Fill in the name of the city or town in the designated field at the top of the form.

- Enter your name as the Collector of Taxes in the appropriate section.

- Provide a detailed description of the property being taken. Ensure that this description is precise and aligns with the notice of taking. If applicable, include the Certificate of Title Number along with the corresponding registration volume and page.

- Indicate the name of the individual for whom taxes were assessed in the section regarding unpaid taxes.

- Enter the fiscal year for which the taxes were not paid.

- Fill out the amounts in the designated fields for the remaining unpaid taxes, interest accrued to the date of taking, and any incidental expenses or costs that have been accumulated.

- Calculate the total amount for which the land is being taken and input this figure into the 'Total for which Land is Taken' field.

- Date the instrument appropriately in the space provided before finalizing the form.

- The Collector of Taxes must sign and print their name in the specified areas, ensuring that all information is accurate.

- Finally, after completion, you can save changes, download, print, or share the filled-out form as needed.

Begin filling out your documents online now to ensure timely submission.

When filing your Massachusetts tax return, make sure to include your W-2 forms and any 1099s if you have other income. You should also provide documentation for deductions and credits that apply to you. It’s crucial to ensure accuracy and completeness to avoid any delays. Utilize resources like the Instrument Of Taking - Mass - Mass. website for specific guidelines and requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.