Loading

Get Vr 334 06 10 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vr 334 06 10 Form online

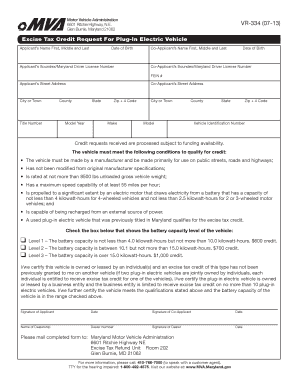

Filling out the Vr 334 06 10 Form is an essential step for requesting an excise tax credit for plug-in electric vehicles. This guide will provide you with a detailed, step-by-step approach to ensure that you accurately complete the form online.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and launch it in your browser.

- Enter the applicant’s name in the designated field, ensuring to include the first, middle, and last names.

- Provide the date of birth of the applicant. Use the format MM/DD/YYYY for clarity.

- Input the applicant’s Soundex/Maryland driver license number accurately in the specified section.

- If applicable, enter the co-applicant’s details including their name, date of birth, and Soundex/Maryland driver license number.

- Complete the address fields for both the applicant and co-applicant. Include the street address, city or town, county, state, and zip code.

- Fill in the vehicle’s title number and vehicle identification number (VIN) in the provided areas.

- Select the battery capacity level that corresponds to your vehicle by checking the appropriate box. You will find three levels with different credit amounts.

- Review the certification statement and ensure that all statements apply to your situation. By signing, you will affirm the information provided is correct.

- Provide the names and signatures of the applicant and co-applicant along with the dates.

- If applicable, enter the name of the dealership and the dealer number where the vehicle was purchased.

- Once all fields are completed, you can save changes, download the completed form, print it for mailing, or share it as needed.

Complete your Vr 334 06 10 Form online today to claim your tax credit!

To apply for the California electric vehicle rebate, visit the California Clean Vehicle Rebate Project website. You'll need to provide documentation that proves your vehicle's eligibility and fill out necessary forms. The Vr 334 06 10 Form can serve as a guide to ensure your application is complete.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.